How to Process a Refund MyFundAccounting.Online

1. You may need to record a refund into your accounts if you have received money back on one of your expenses. This might be a refund from insurance, gas or electricity companies for example.

How can we record this transaction?

The transaction is recorded through record expenditure. Refunds are recorded against the original bank account and expenditure nominal account chosen during the initial payment recording.

Please see further instructions below:

2. Select "Record Expenditure"

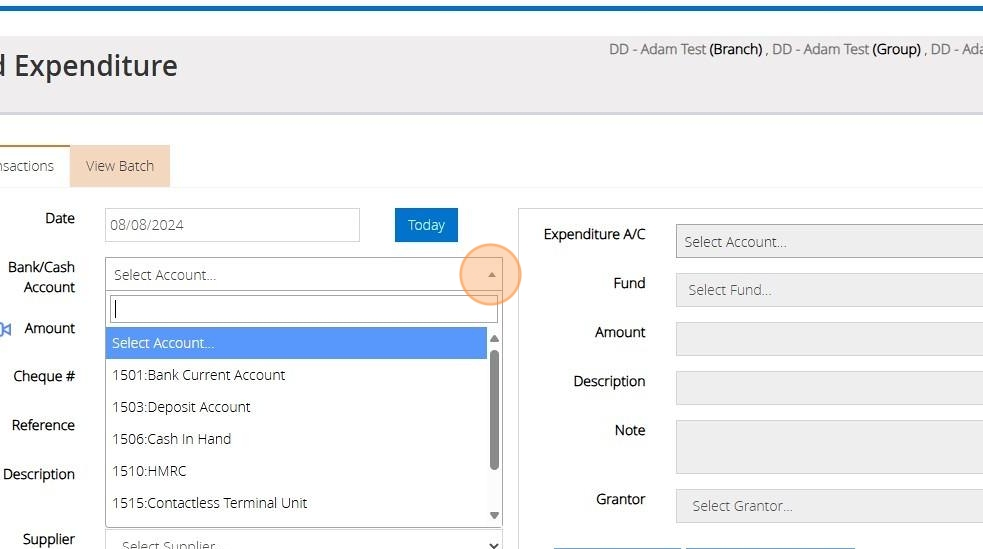

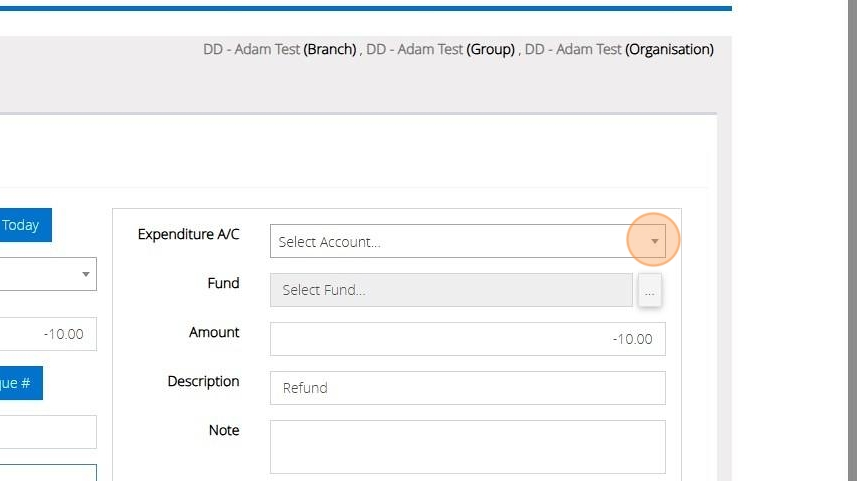

3. Choose the "Bank/ Cash Account" that the refund will need to be processed against.

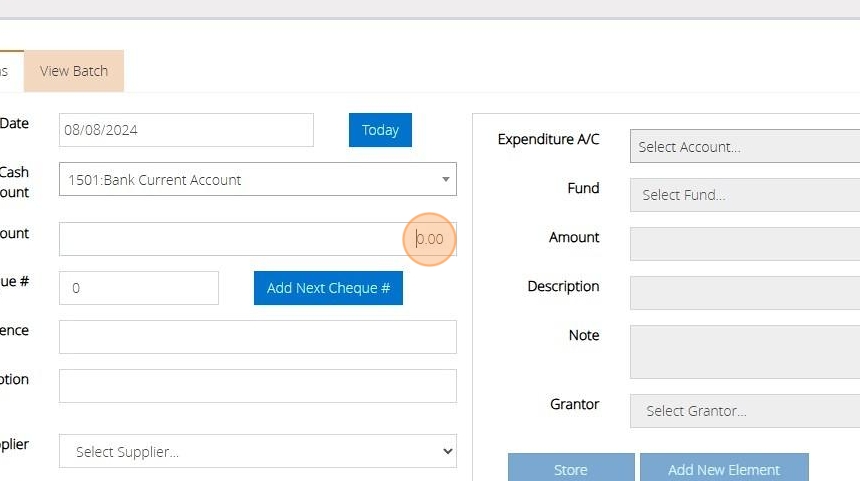

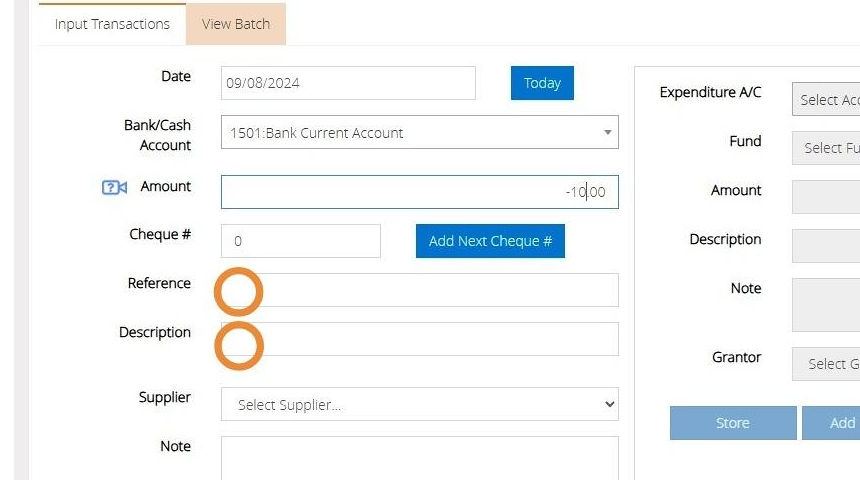

4. Input the amount as a negative figure to indicate a refund. This is done because a negative entry will decrease the total expenses and reflect as "money in" on the bank account.

5. Enter a reference or description or reference if required.

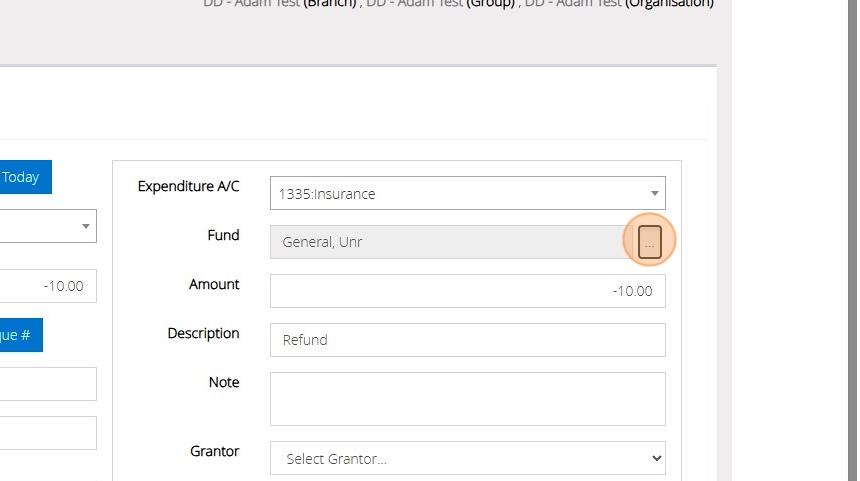

6. Select the "Expenditure A/C" nominal account where the original payment was recorded. This needs to be reflected against the original payment as it represents a reduction in the amount charged to the original "Expenditure A/C," which will also decrease your total expenses.

7. Select the fund that was used in the original transaction, you can do this by clicking "..."

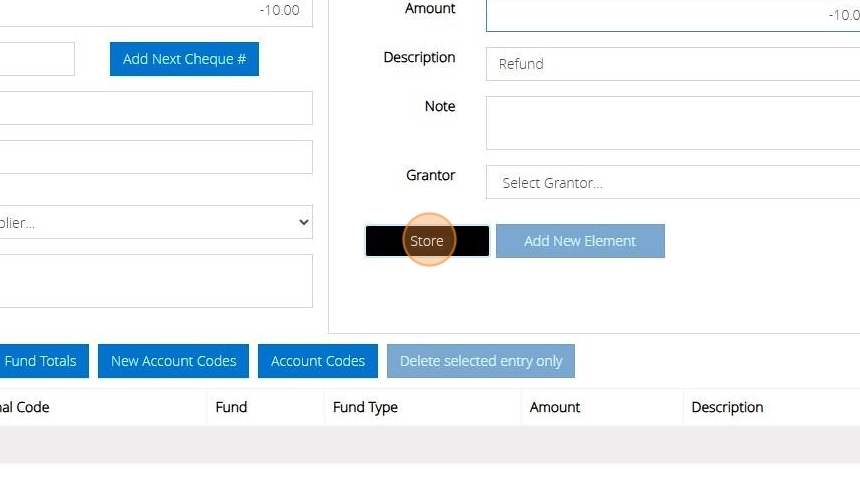

8. Once you have completed entering the information click "Store" then "Post".

9. This process can also be utilised for income transactions, such as when a donor has made a duplicate donation and wishes to have the money returned, or when a cheque is listed on the bank statement but is then refunded due to incorrect information. It can be managed by recording negative income against the code where the original income was recorded and bank account.