Tip: It is possible that you will have paid for an item or a service and not received it by the end of the financial year. This is a prepayment, and including it in your accounts at year-end will give a more accurate picture. The Charity Commission require larger churches and charities to adopt this type of accounting, see the SORP document for more information.

1. Navigate to https://www.myfundaccounting.online

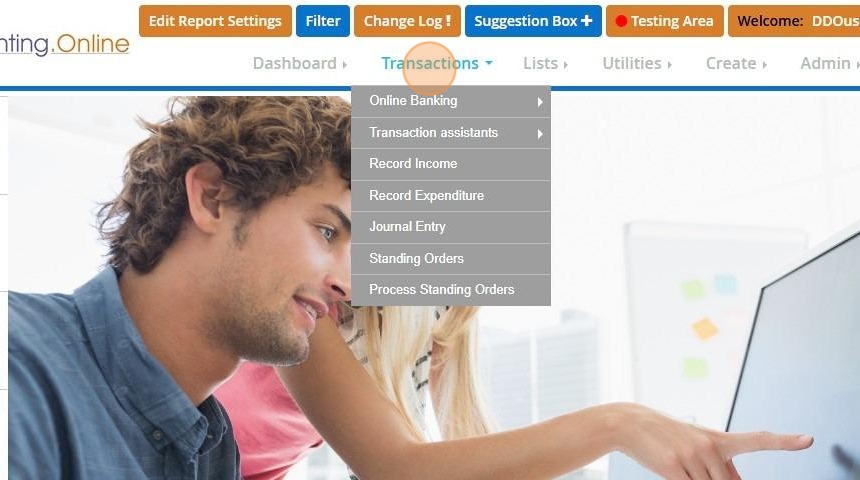

2. Click "Transactions"

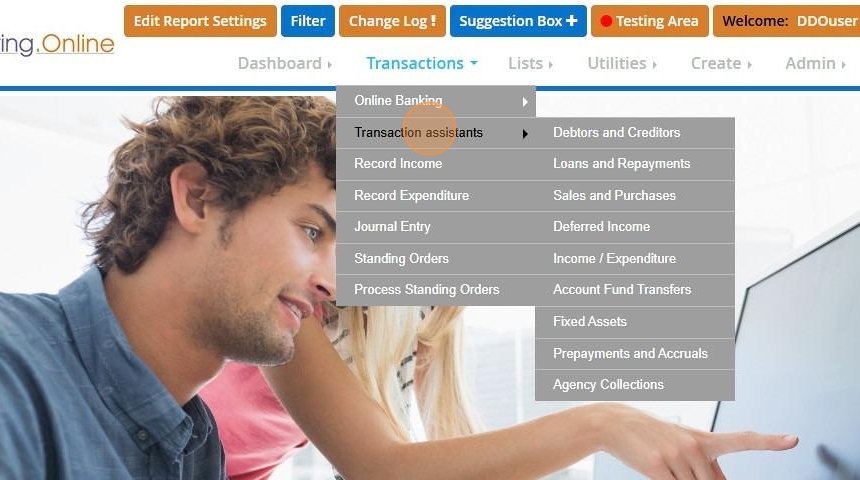

3. Click "Transaction assistants"

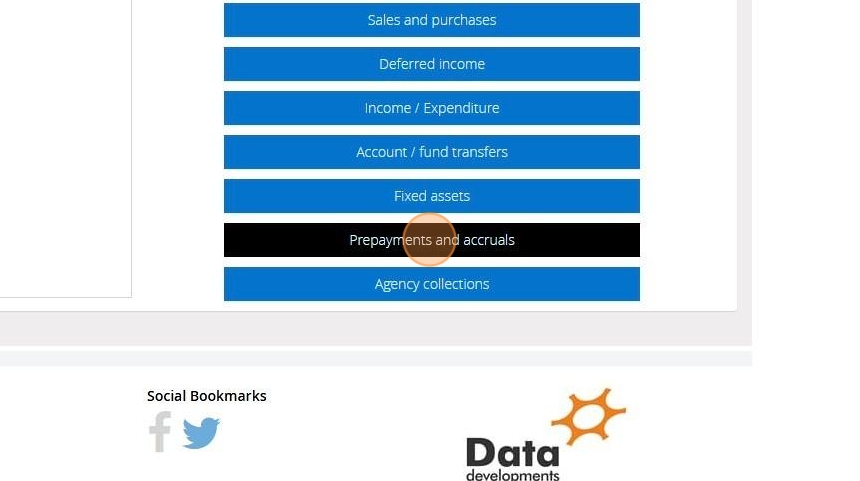

4. Click "Prepayments and accruals"

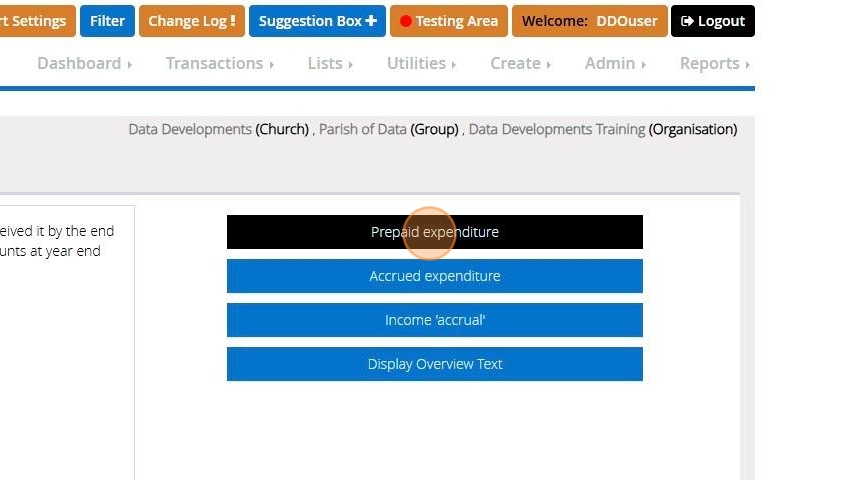

5. Click "Prepaid expenditure"

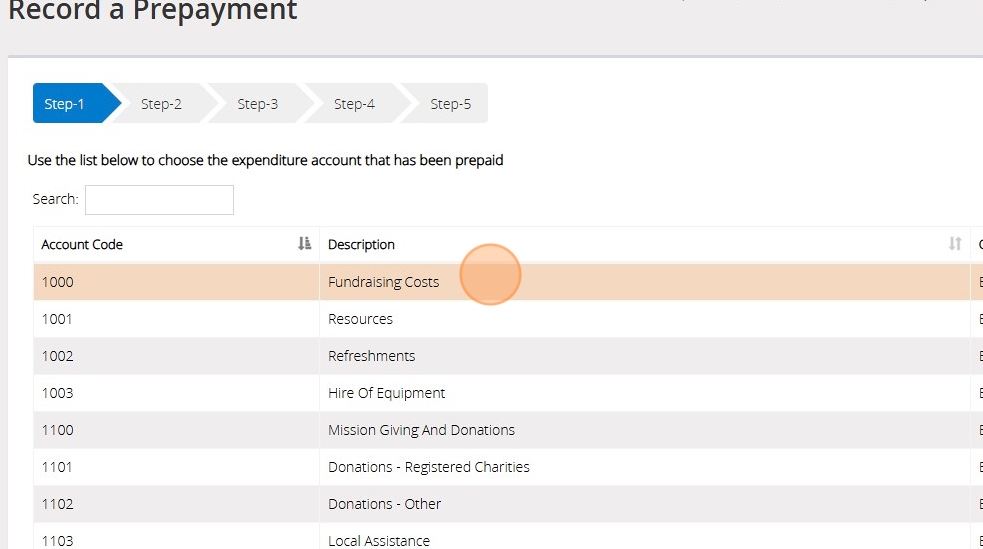

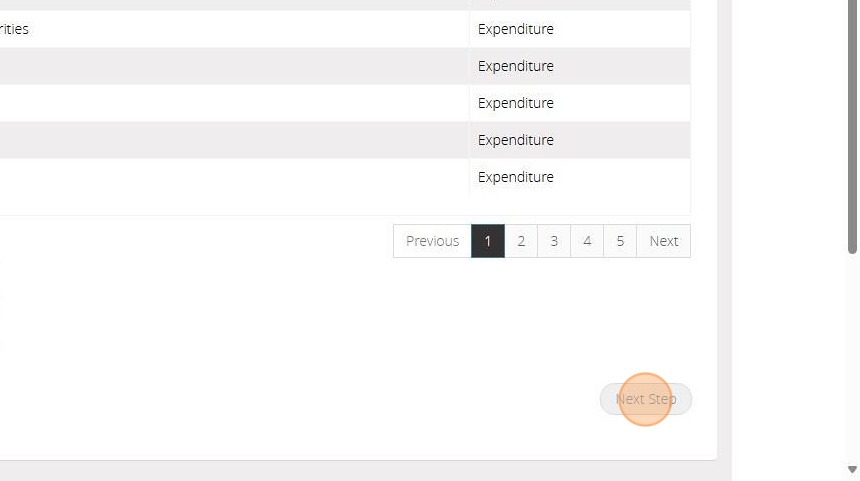

6. On Step 1 Select the Expenditure code that has been prepaid

7. Click "Next Step"

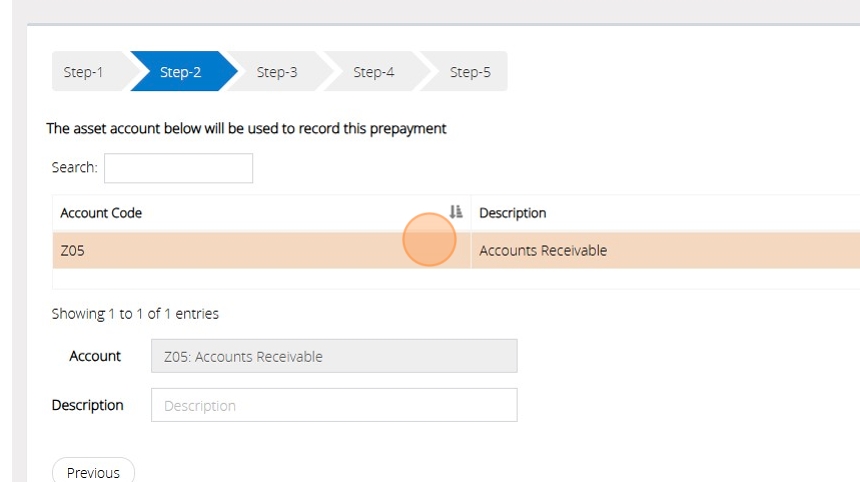

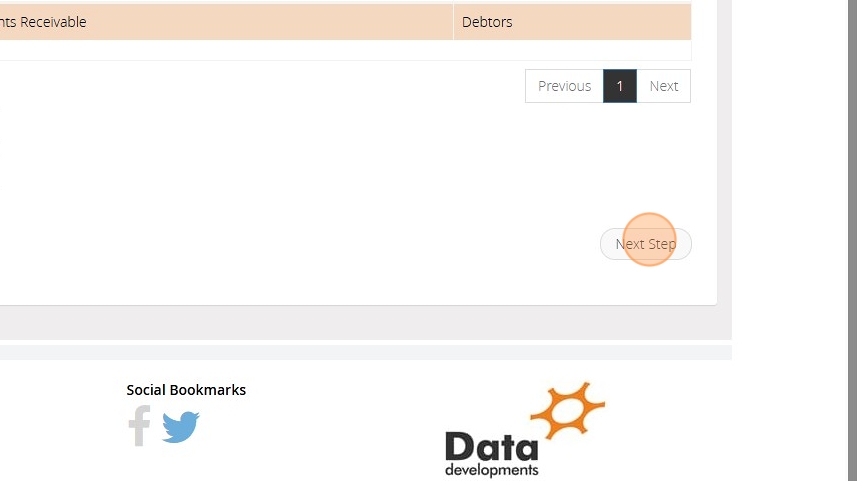

8. On Step 2 select the asset account to be used to record the prepayment. You will have a default code for Accounts Receivable that can be used.

9. Click "Next Step"

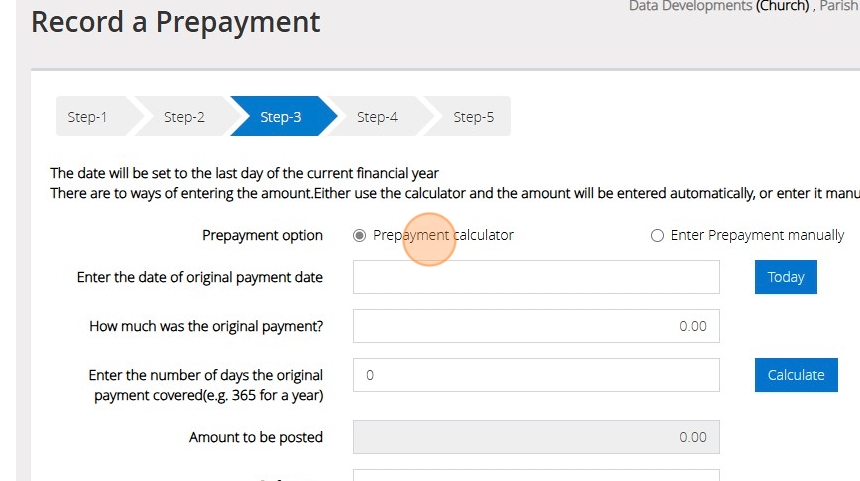

10. If you would like the system to calculate it for you do the following:

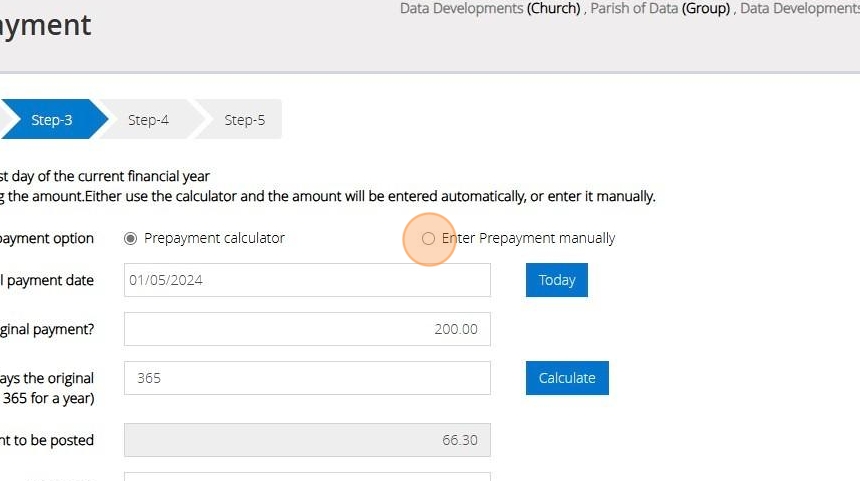

Click 'Prepayment Calculator' and enter the date the original payment was made > Next Enter the amount of the original payment and the number of days the original payment covered.

Click the 'Calculate' button, and the calculated prepayment amount will appear in the 'Amount to be Posted' box.

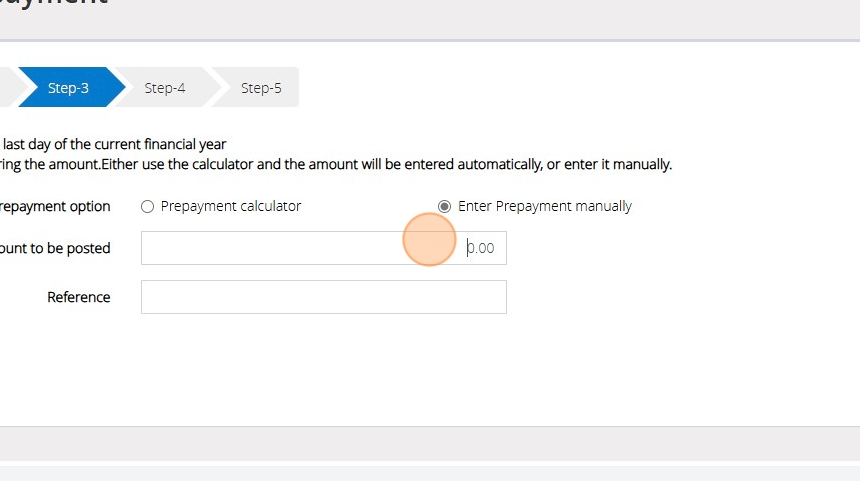

Tip: Alternatively, you can enter the prepayment manually by following the below steps

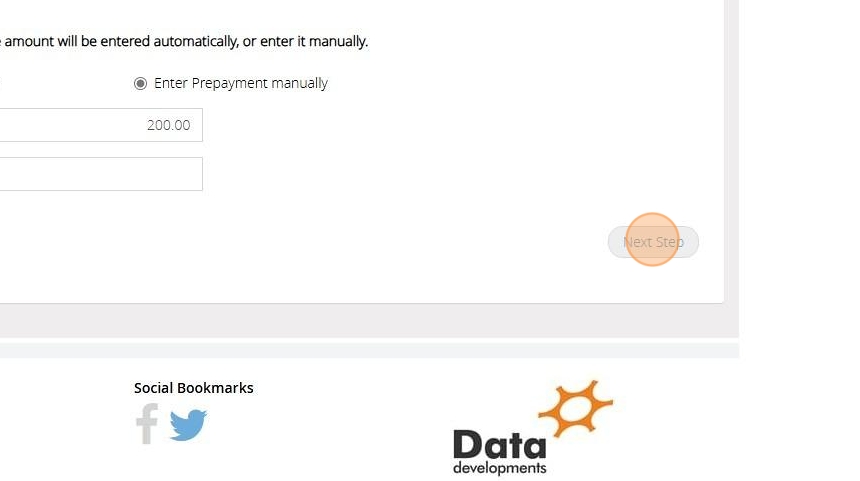

11. Select "Enter Prepayment manually"

12. Enter the amount that has been prepaid and a enter a reference

13. Click "Next Step"

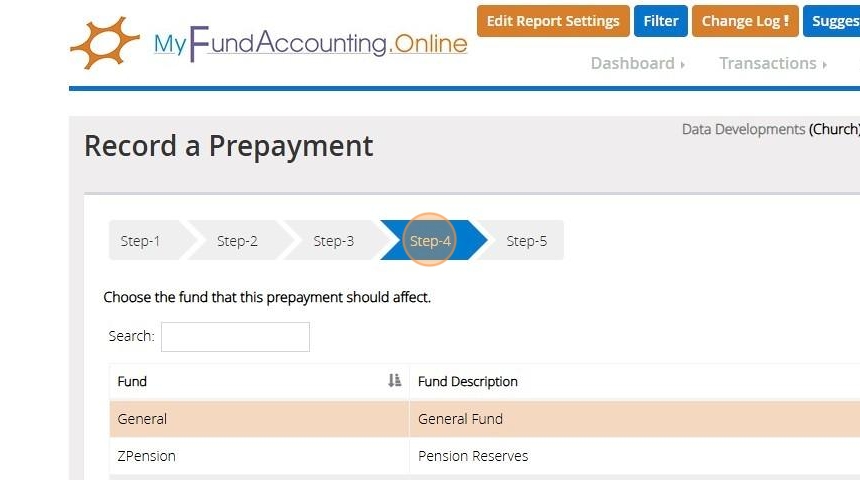

14. On Step 4 select the fund that the prepayment should affect

15. Click "Next Step"

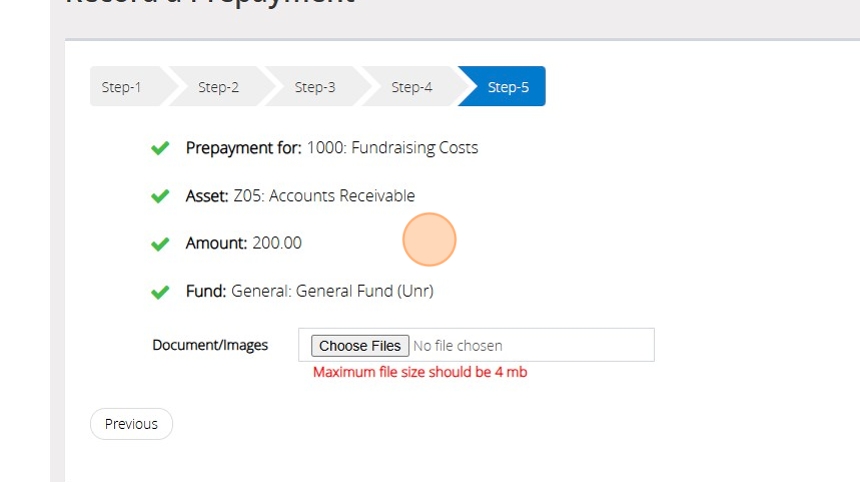

16. Confirm the selections that have been made

17. Click "Save & Post"