Tip: It is possible that you will have not paid for an item or a service and not received it by the end of the financial year. This is an accrual and including it in your accounts at year-end will give a more accurate picture. The Charity Commission require larger churches and charities to adopt this type of accounting, see the SORP document for more information.

1. Navigate to https://www.myfundaccounting.online

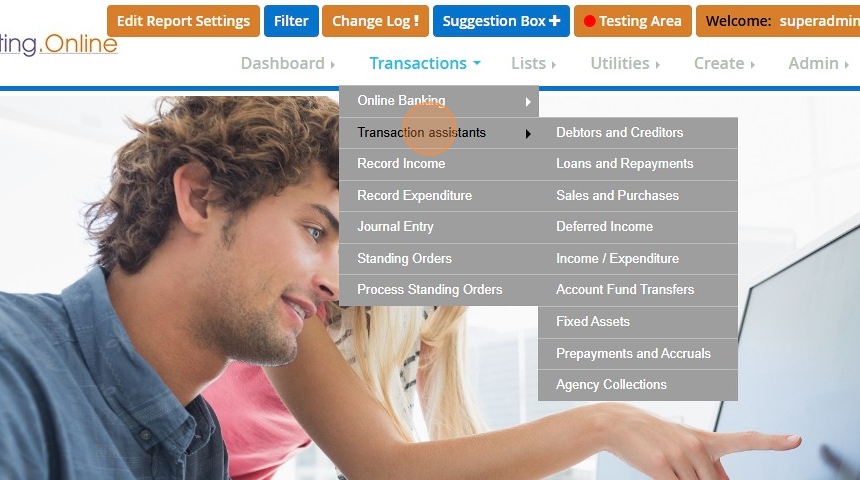

2. Click "Transactions"

3. Click "Transaction assistants"

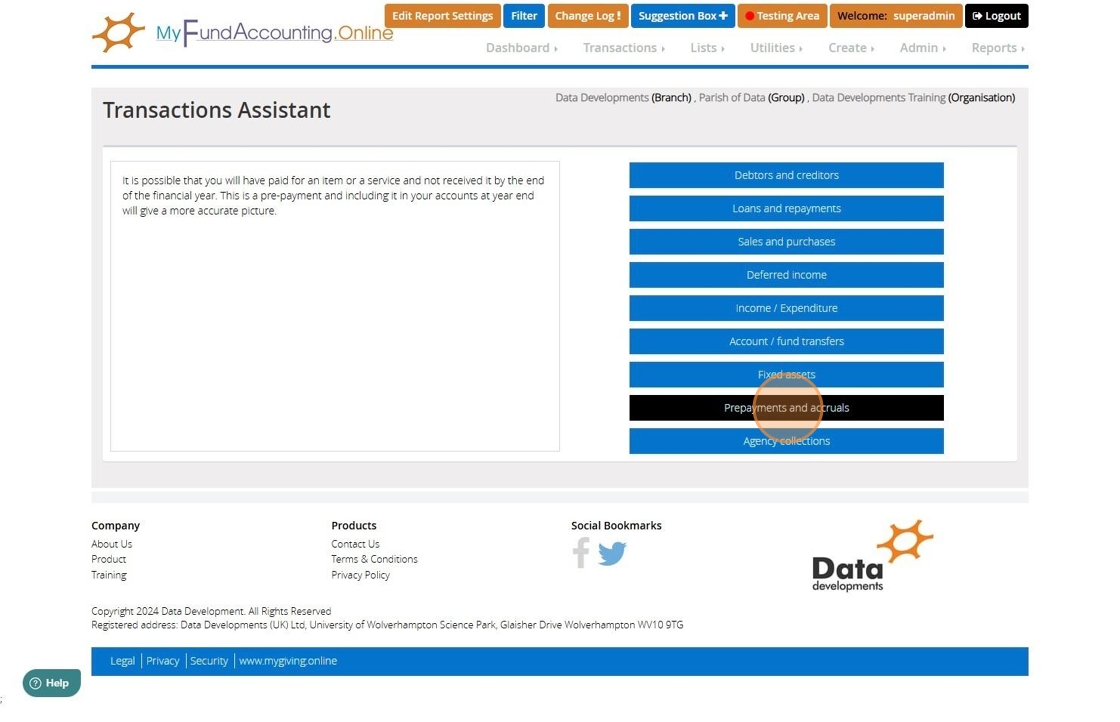

4. Click "Prepayments and accruals"

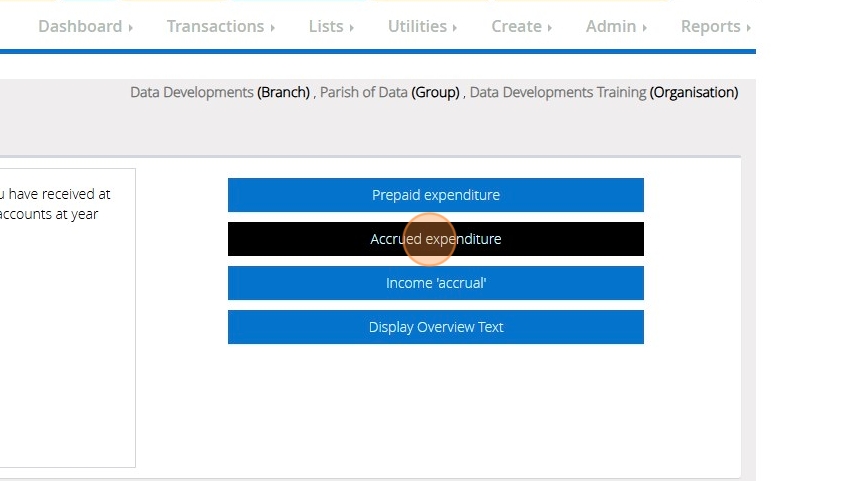

5. Click "Accrued expenditure"

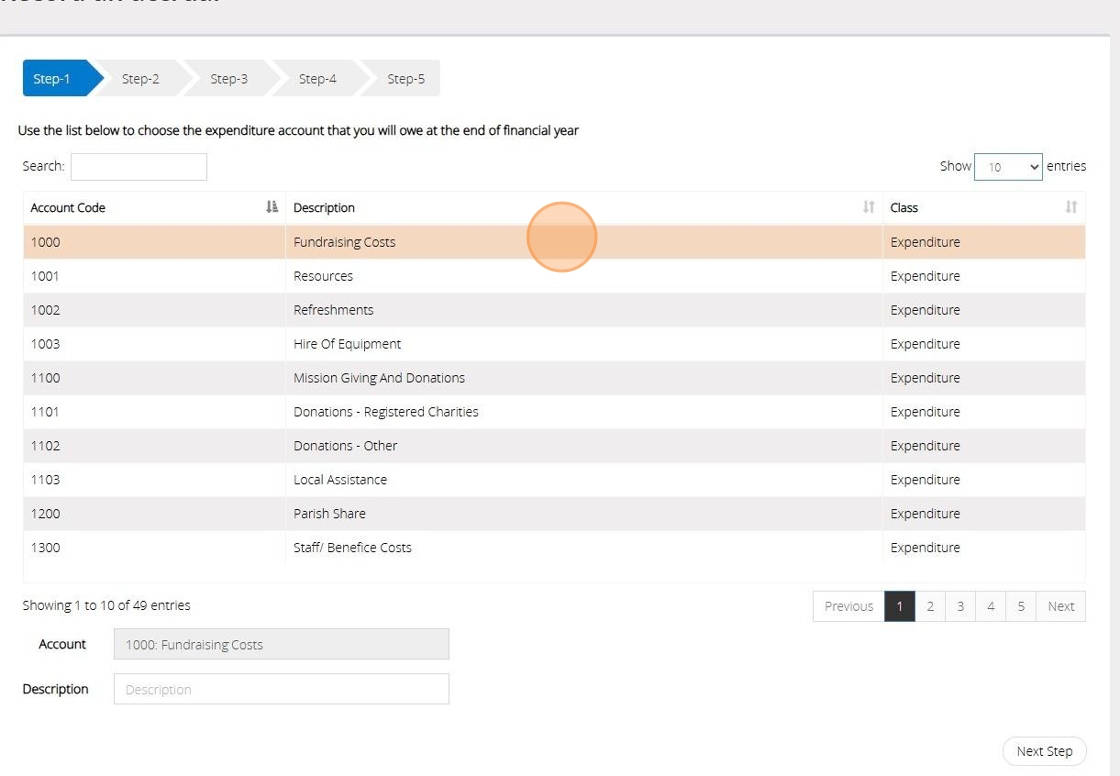

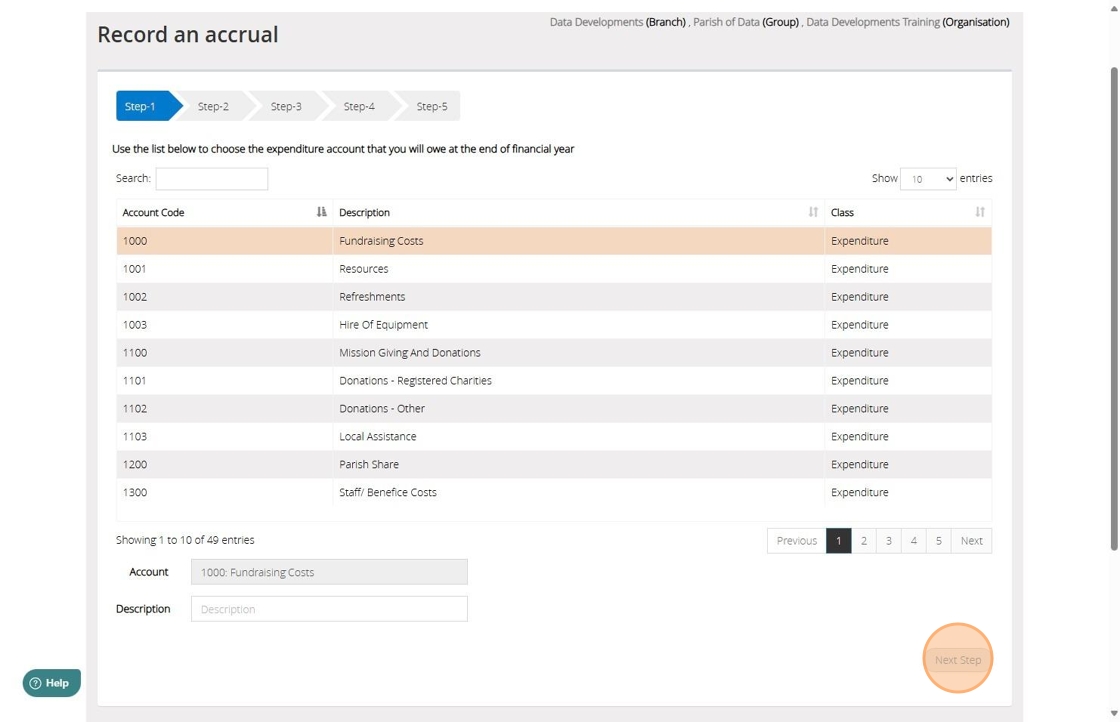

6. Select the expenditure account that you will owe at the end of the financial year

7. Click "Next Step"

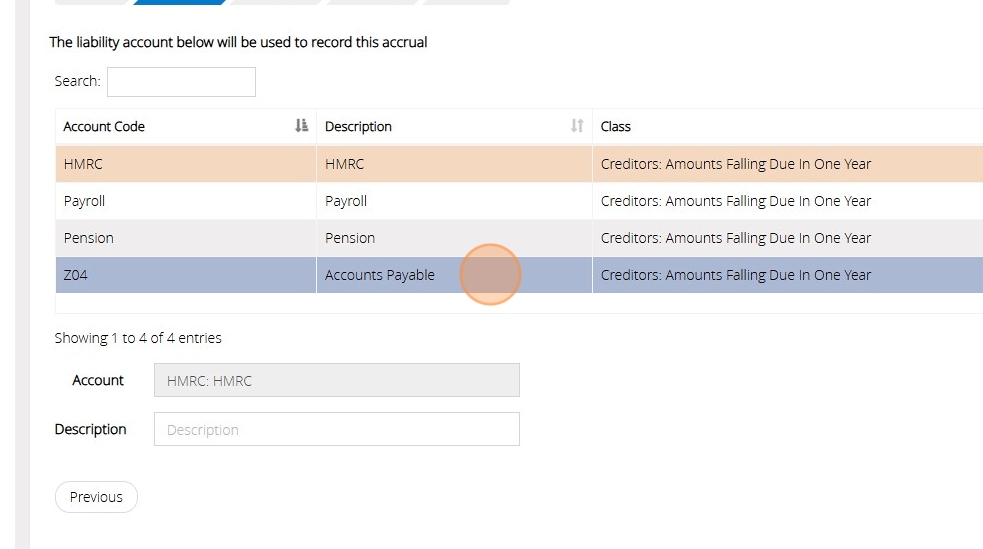

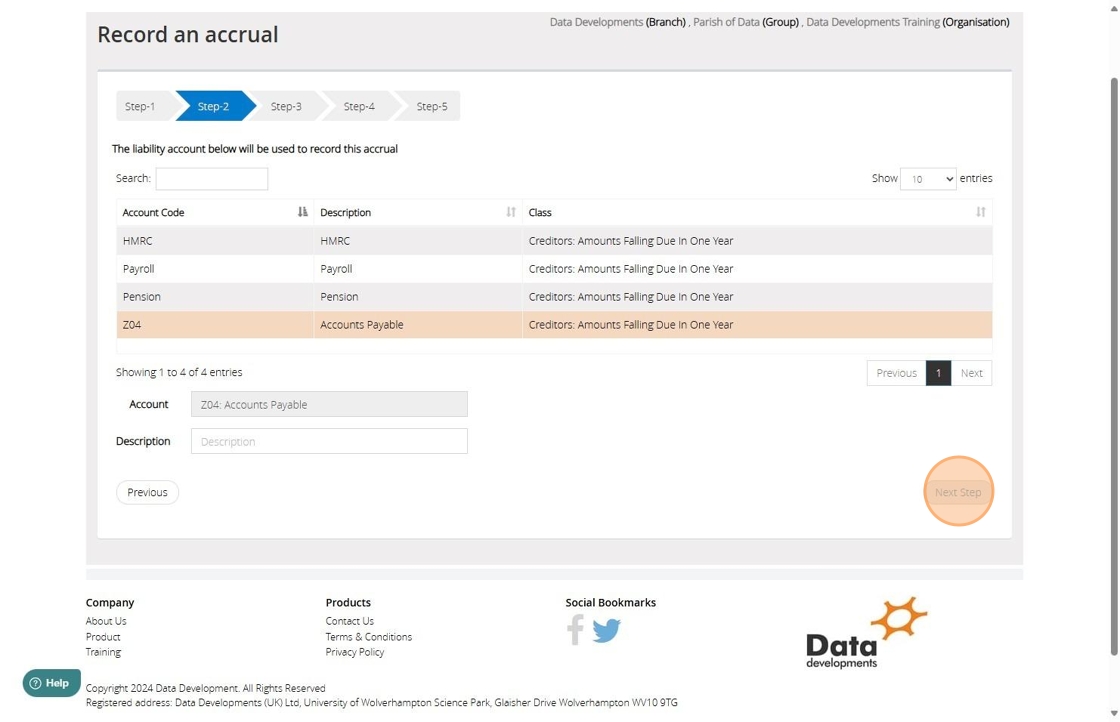

8. [[Select the Liability account to show the amount owed against]]

9. Click "Next Step"

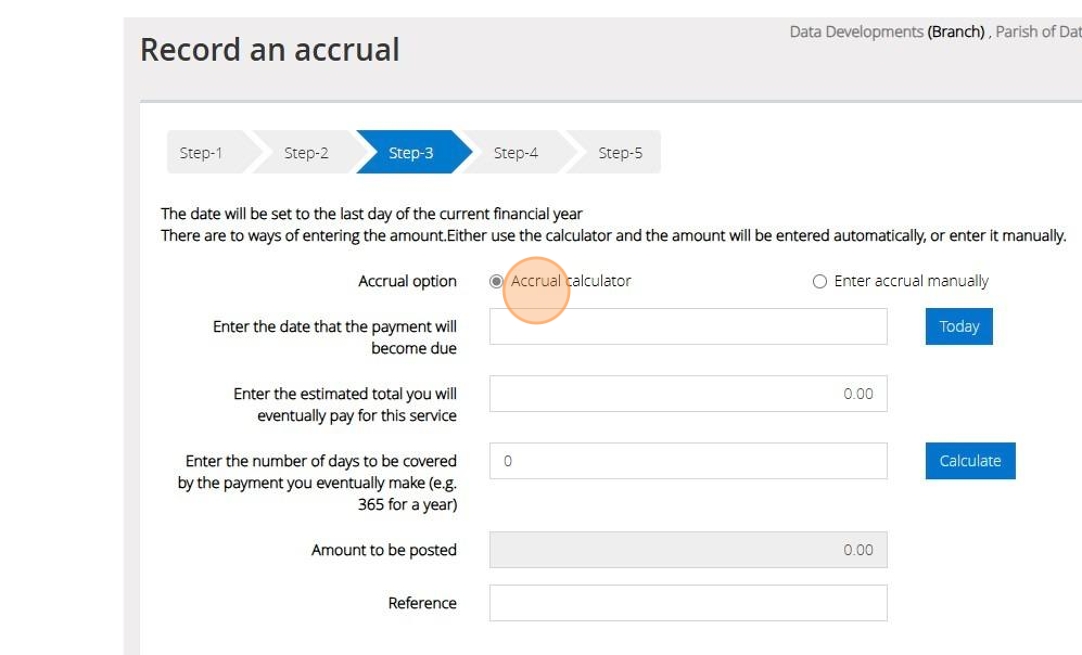

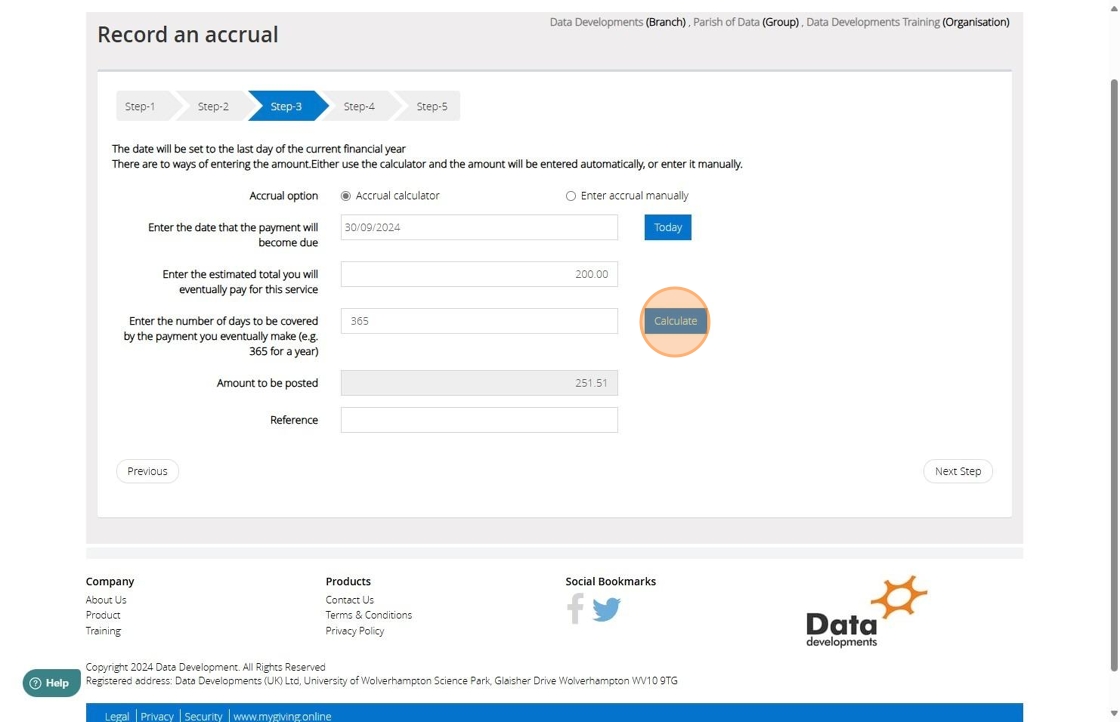

10. If you would like the system to calculate it for you do the following:

Click 'Accrual Calculator' and enter the date the payment will be due > Next Enter the amount you estimate to pay and the number of days to be covered by the prepayment

11. Click the 'Calculate' button, and the calculated amount will appear in the 'Amount to be Posted' box.

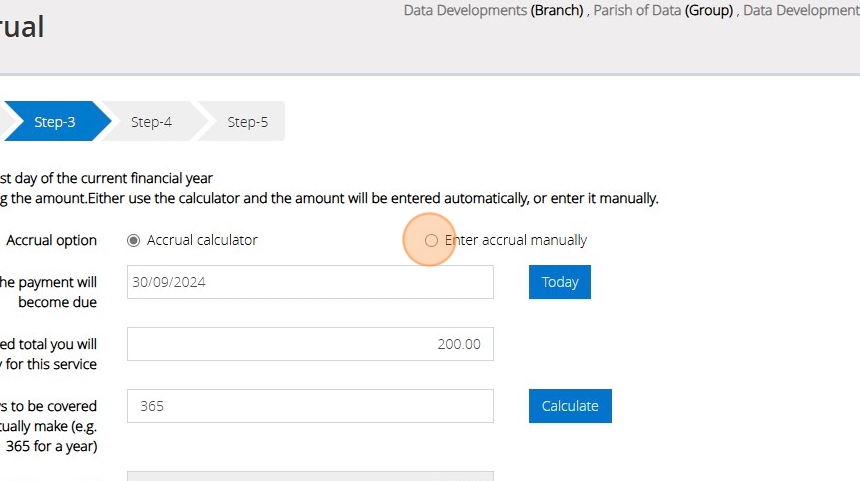

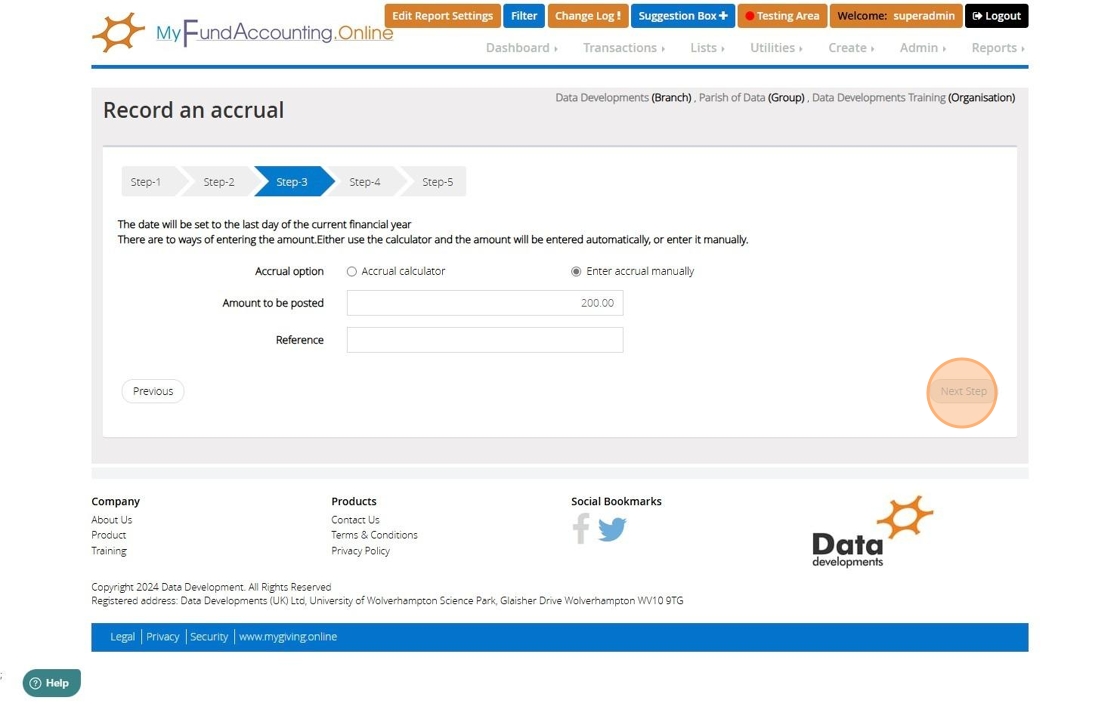

Tip: Alternatively, you can enter the prepayment manually by following the below steps

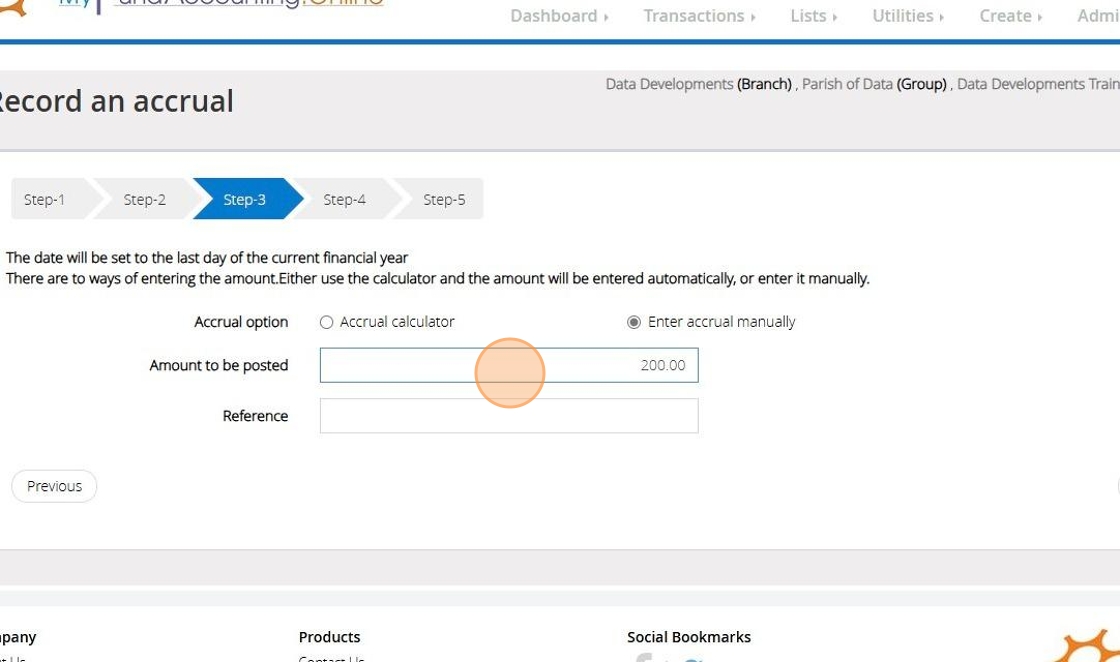

12. Click the "Enter accrual manually" field.

13. Enter the amount to be paid and a reference

14. Click "Next Step"

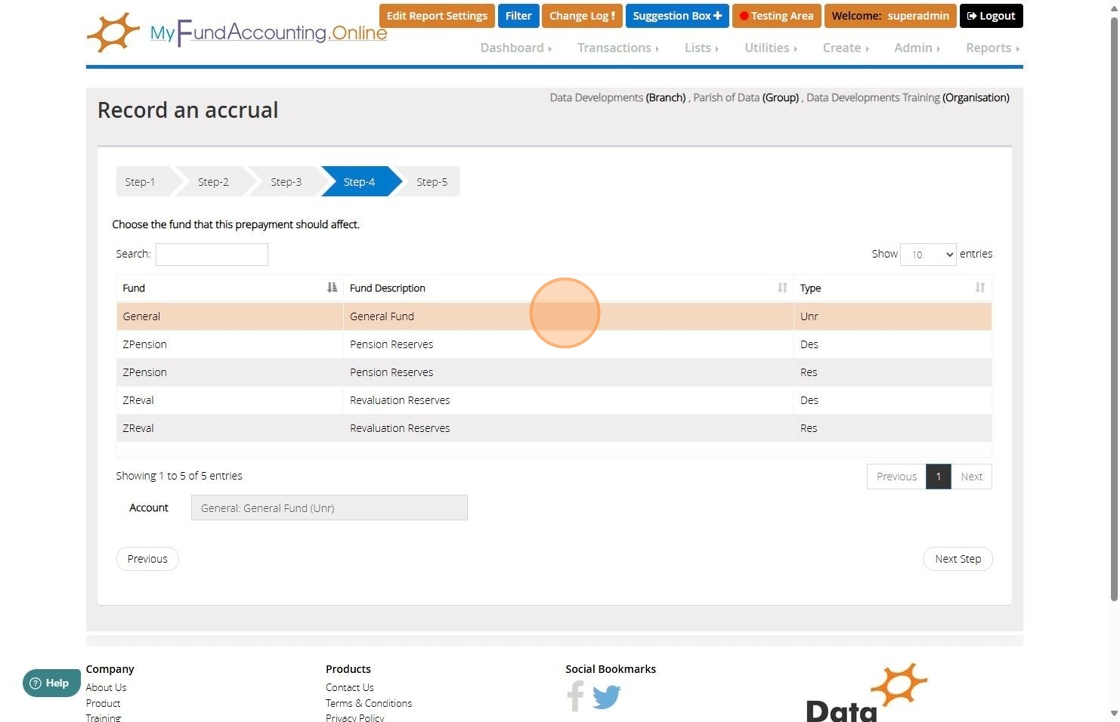

15. Select the fund that the payment should affect

16. Click "Next Step"

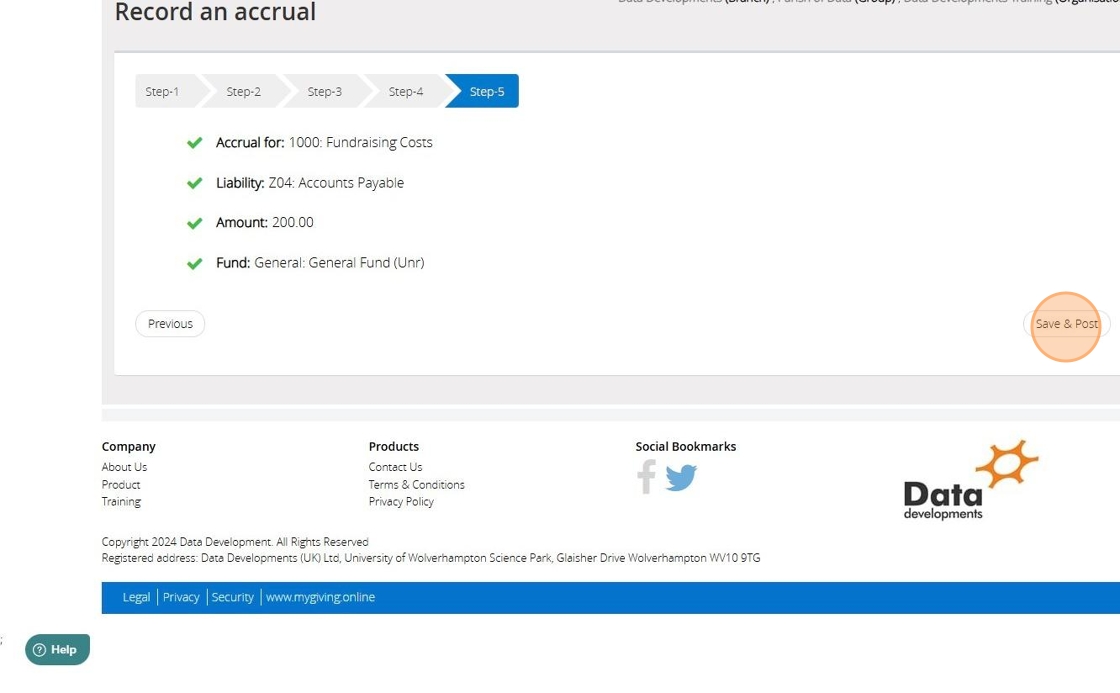

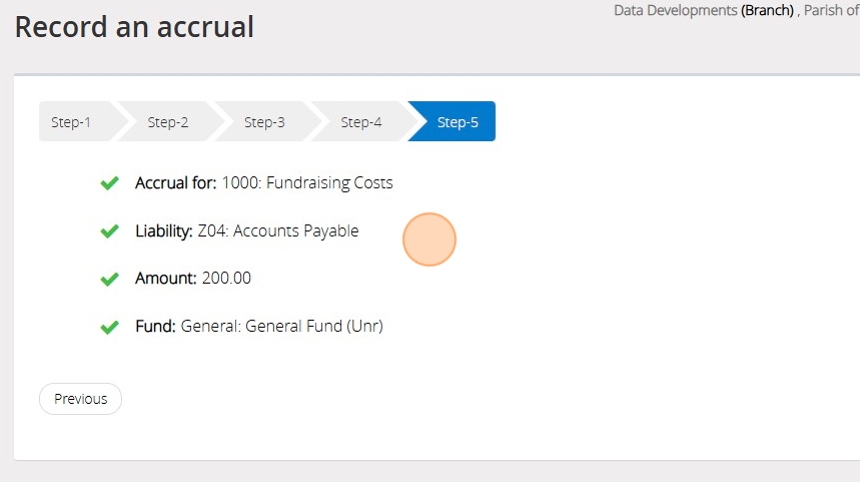

17. Confirm the selections that have been made

18. Click "Save & Post"