Tip: An Income accrual is an amount that you know is coming but has not yet arrived. For example you may be expecting a Gift Aid Claim from HMRC the following January, but your accounts close in December. This transaction will show the expected income, and then reverse it at year end.

1. Navigate to https://www.myfundaccounting.online

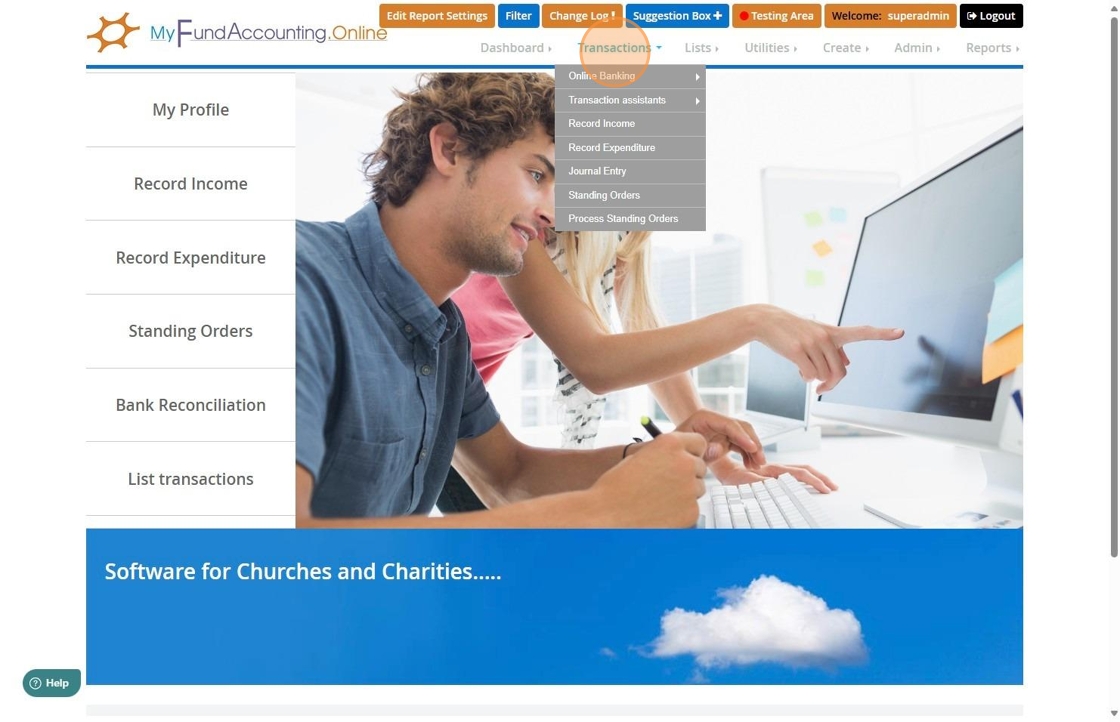

2. Click "Transactions"

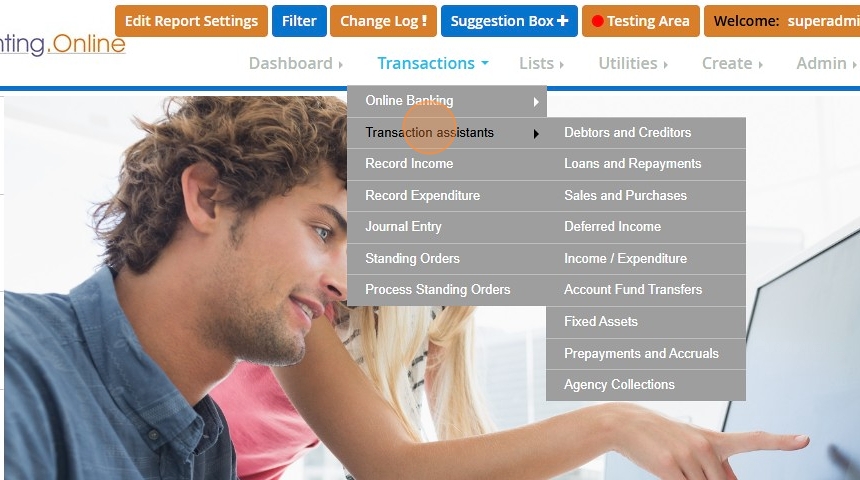

3. Click "Transaction assistants"

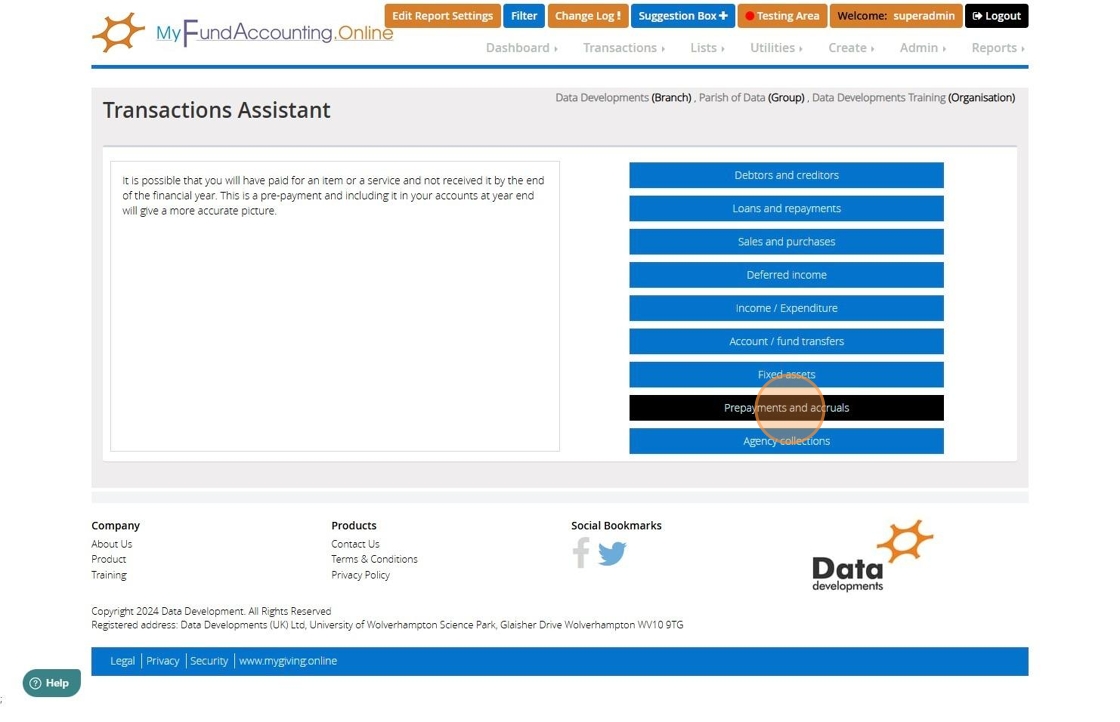

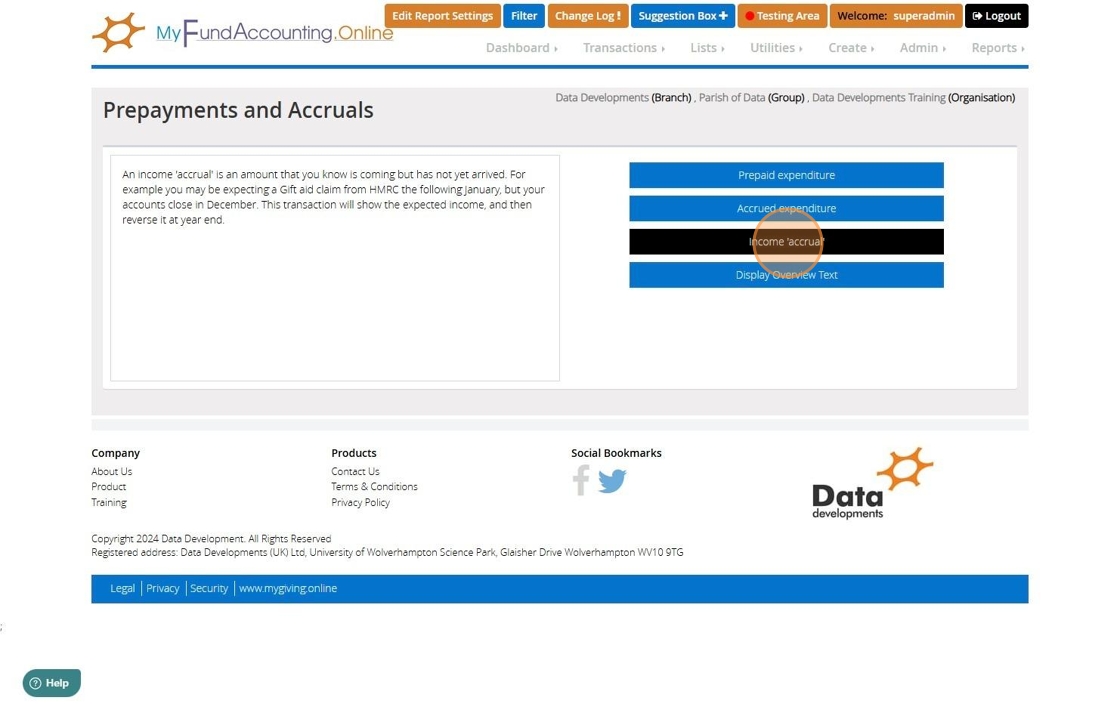

4. Click "Prepayments and accruals"

5. Click "Income 'accrual'"

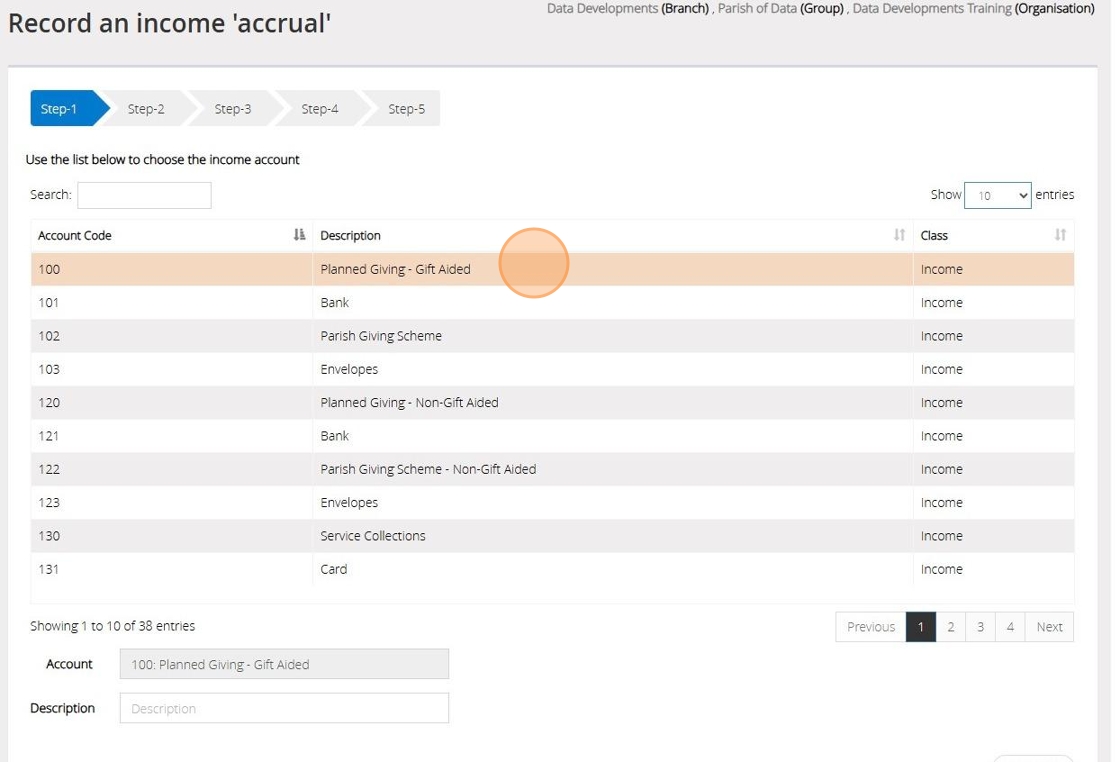

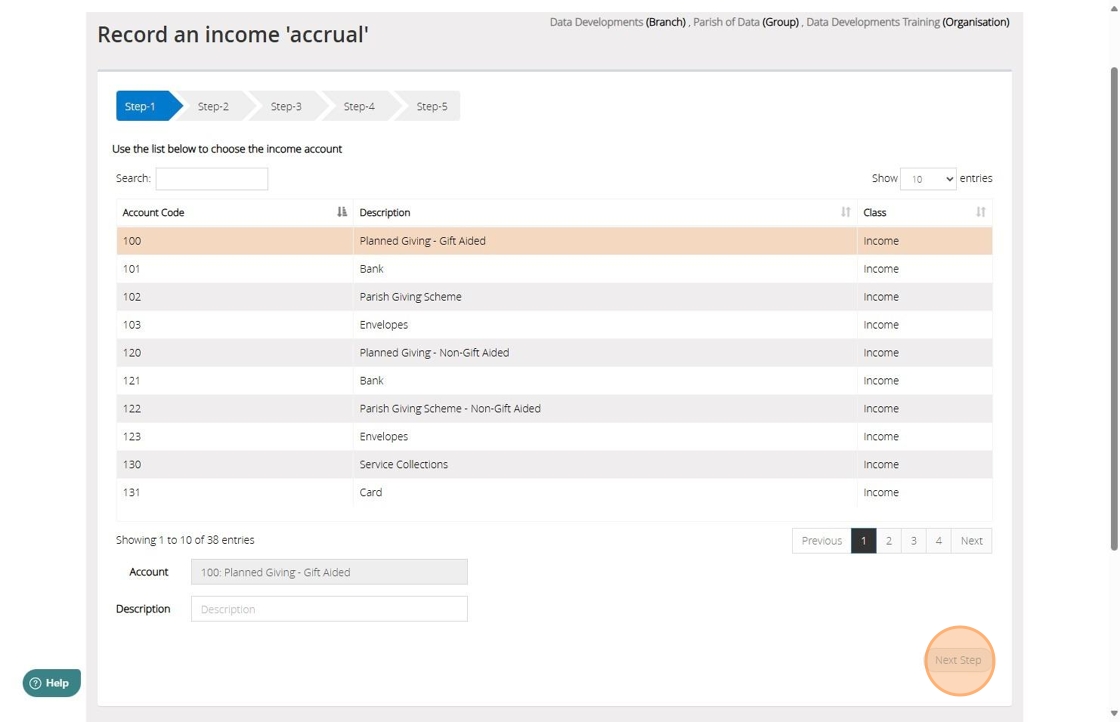

6. On Step 1 select the income account

7. Click "Next Step"

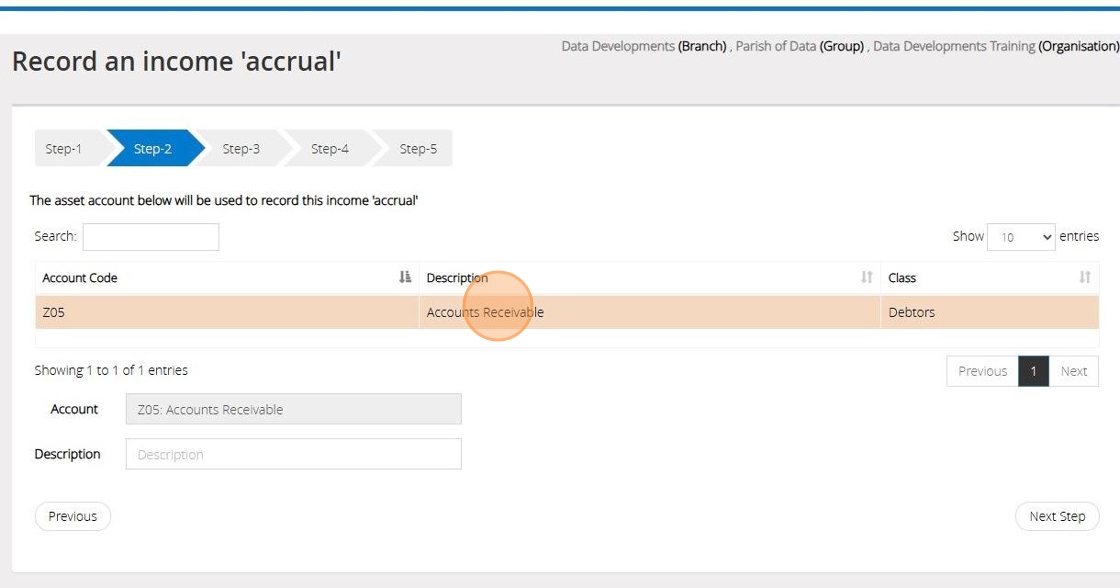

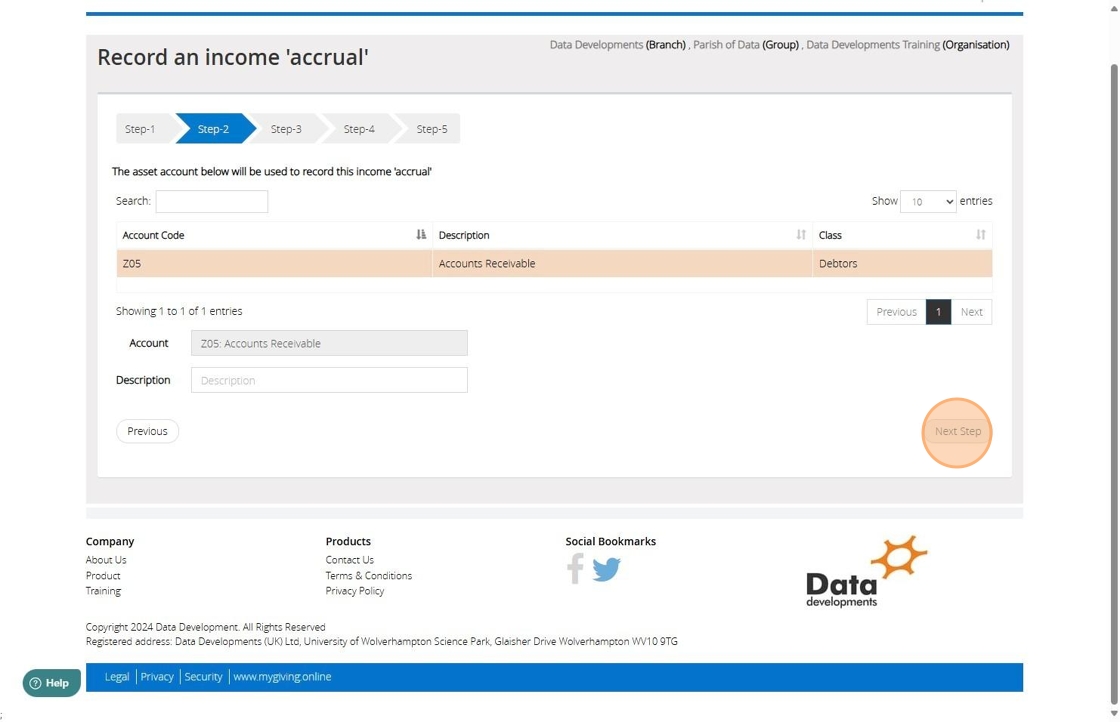

8. [[On Step 2 select the debtor account to be used to record the accrual against]]

9. Click "Next Step"

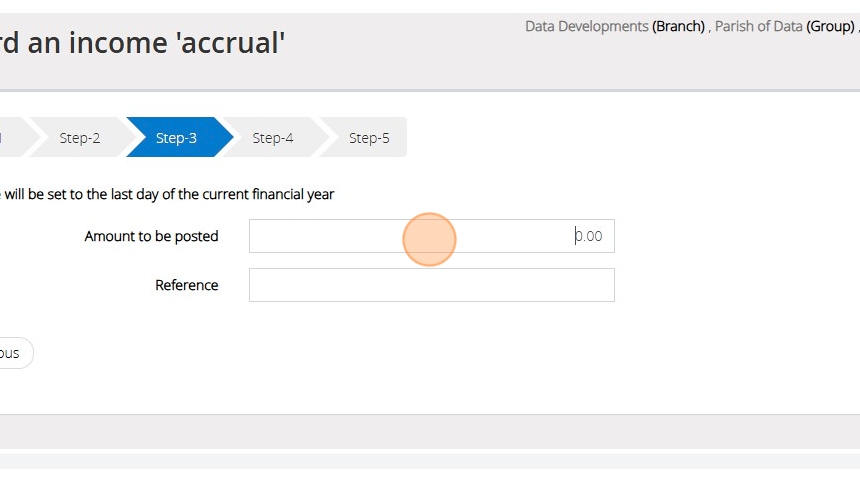

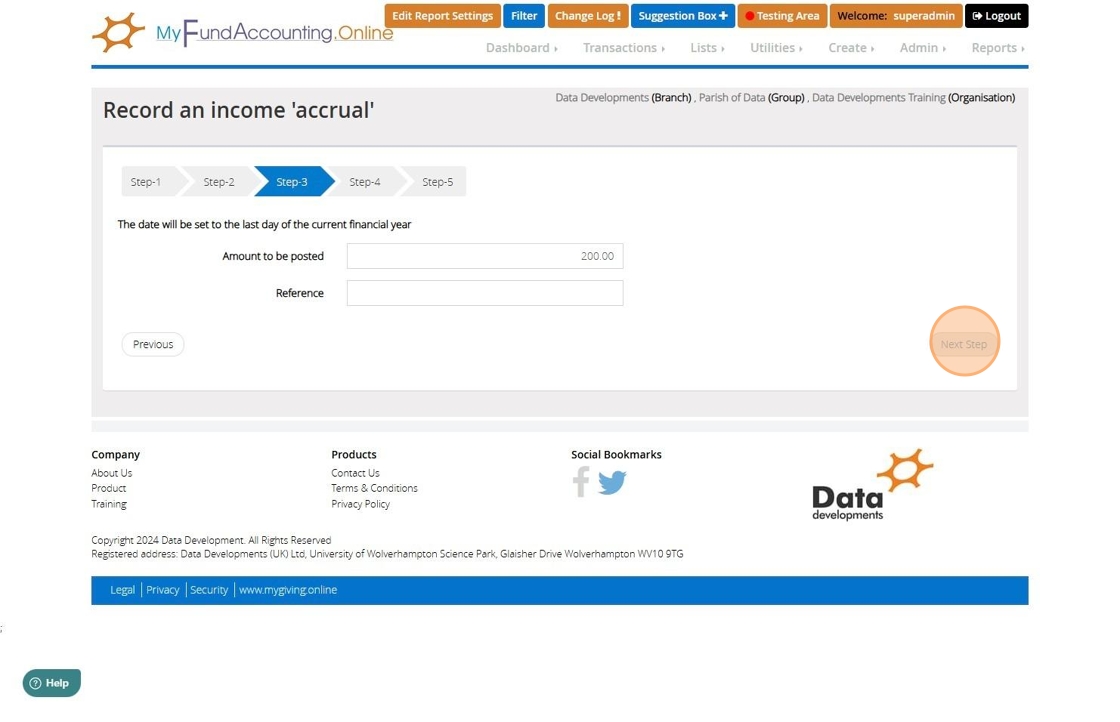

10. On Step 3 enter the amount you expect to receive

11. Click "Next Step"

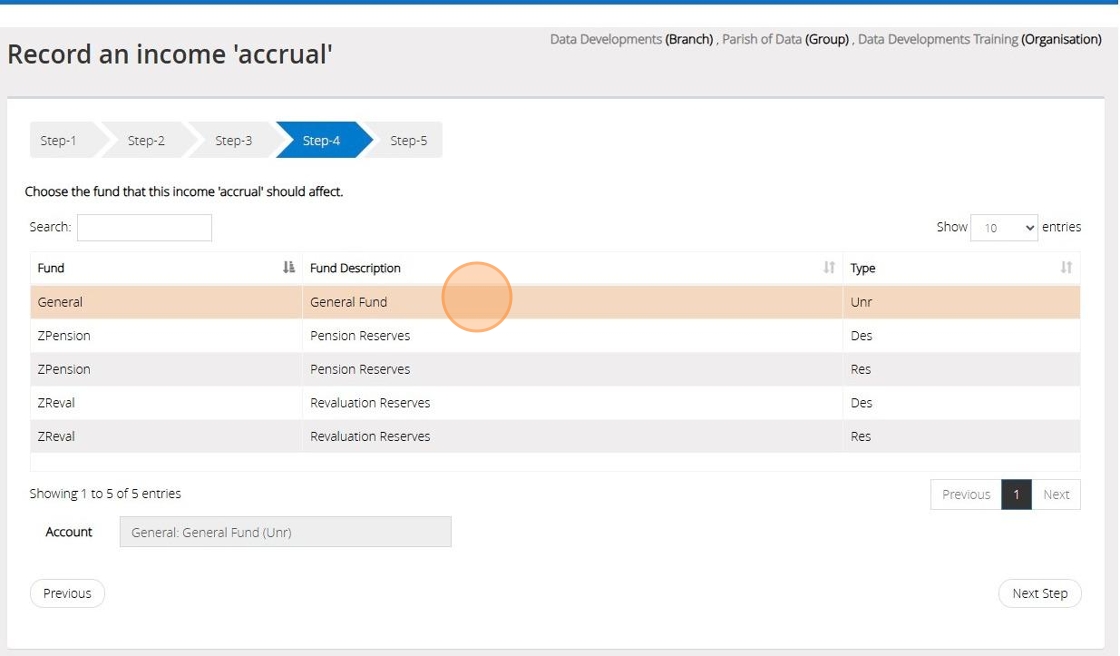

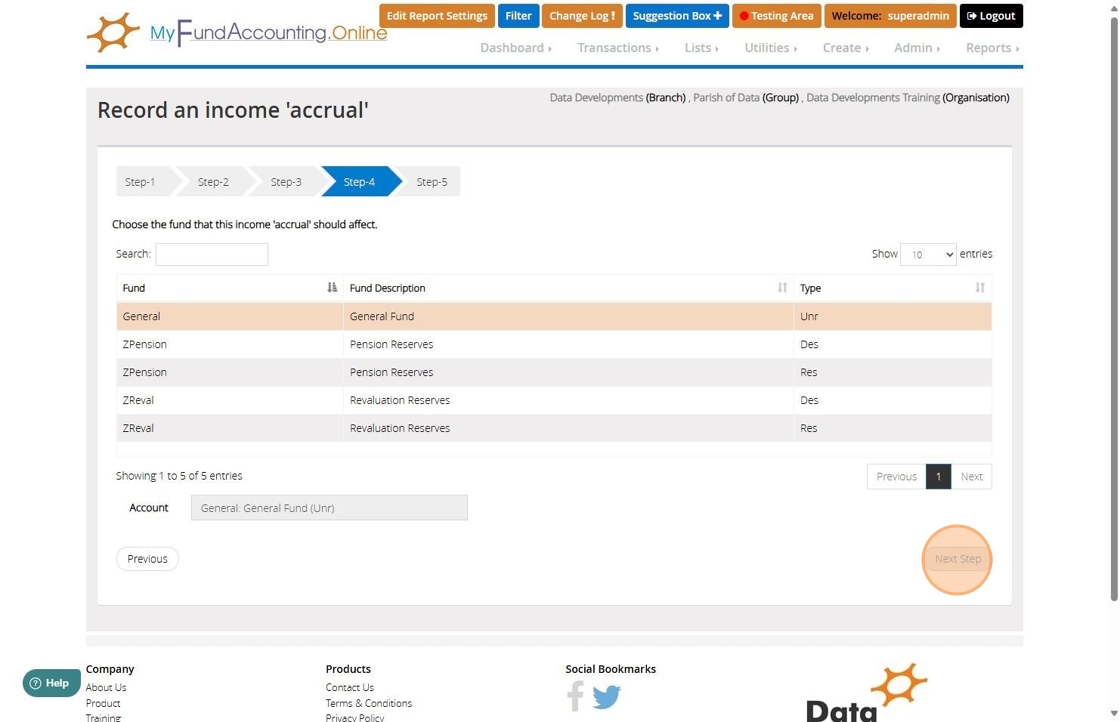

12. On Step 4 select the fund the accrual should affect

13. Click "Next Step"

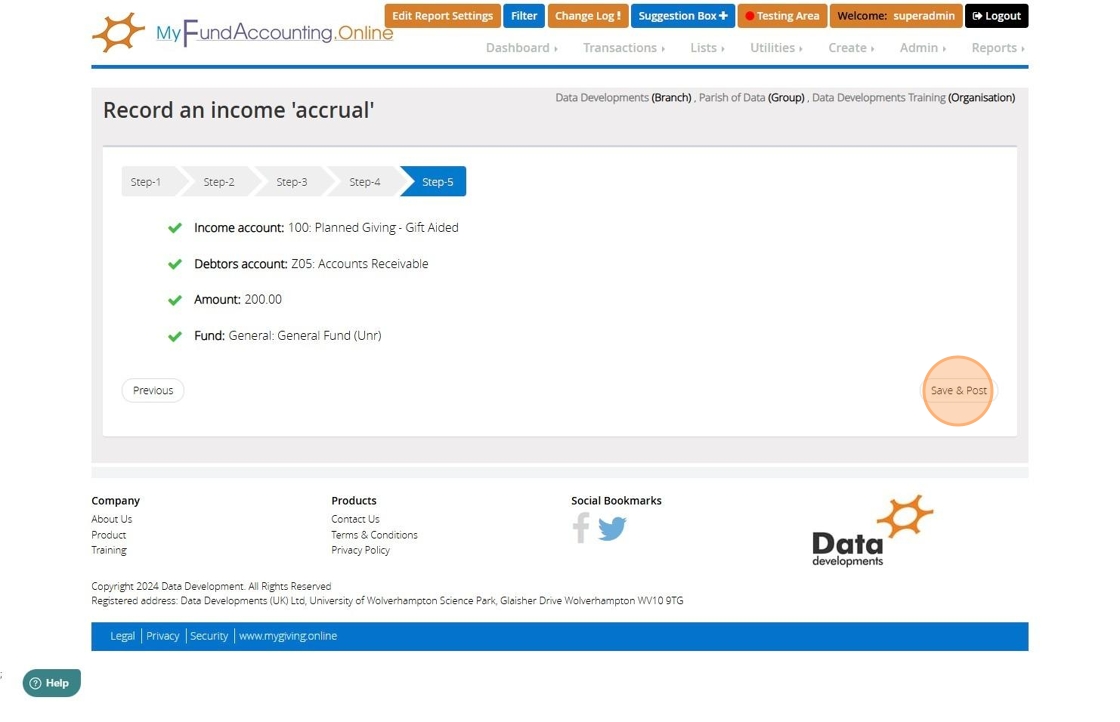

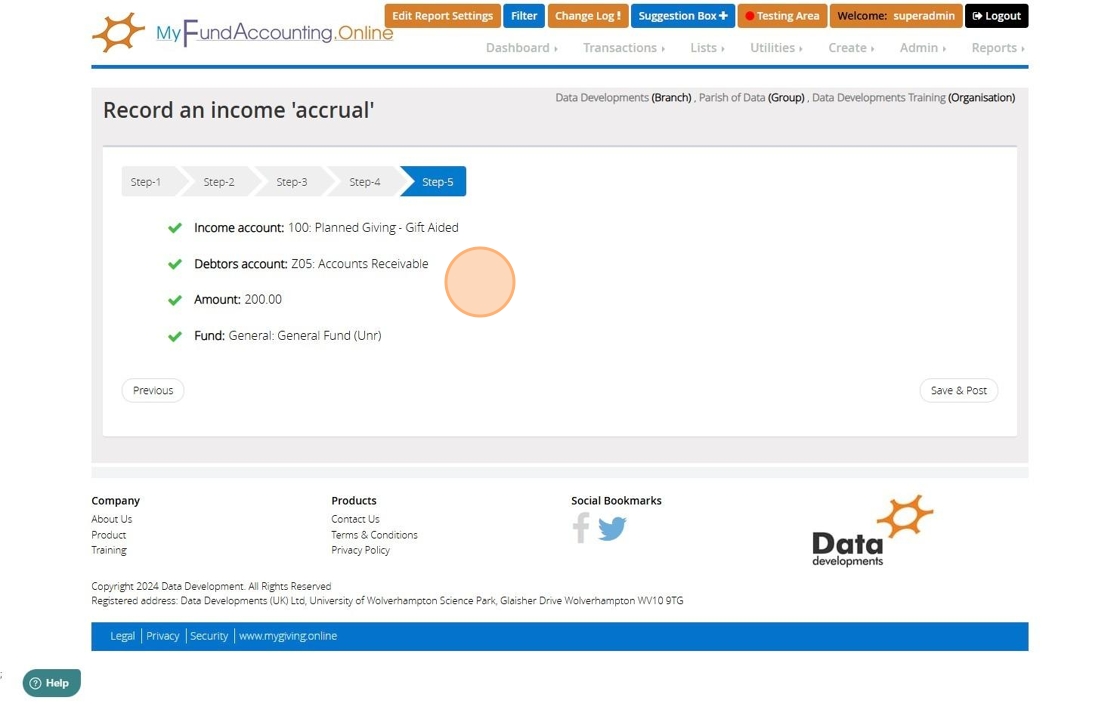

14. Confirm the selections that have been made

15. Click "Save & Post"