Deferred income refers to money received that will be recognised as income at a future date that falls under another financial year. For instance, it can occur when you receive an advance payment for services that you will provide later.

1. Navigate to https://www.myfundaccounting.online

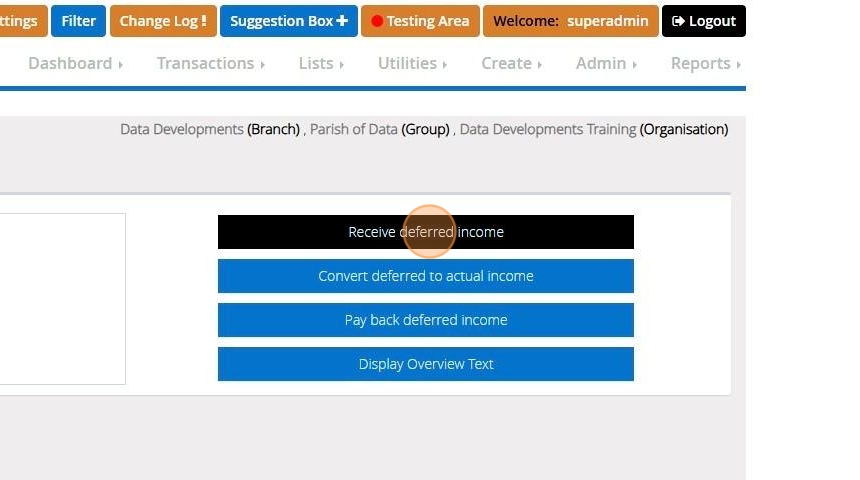

Receive deferred income

The below steps will guide you in recording an amount of deferred income

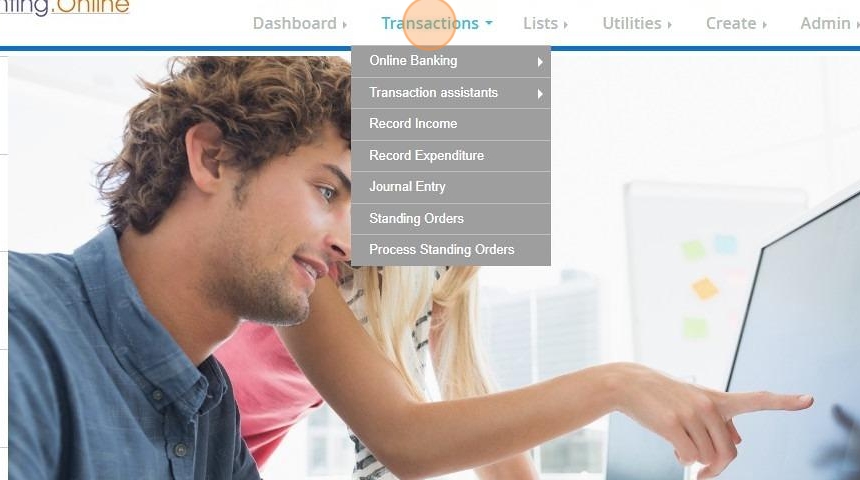

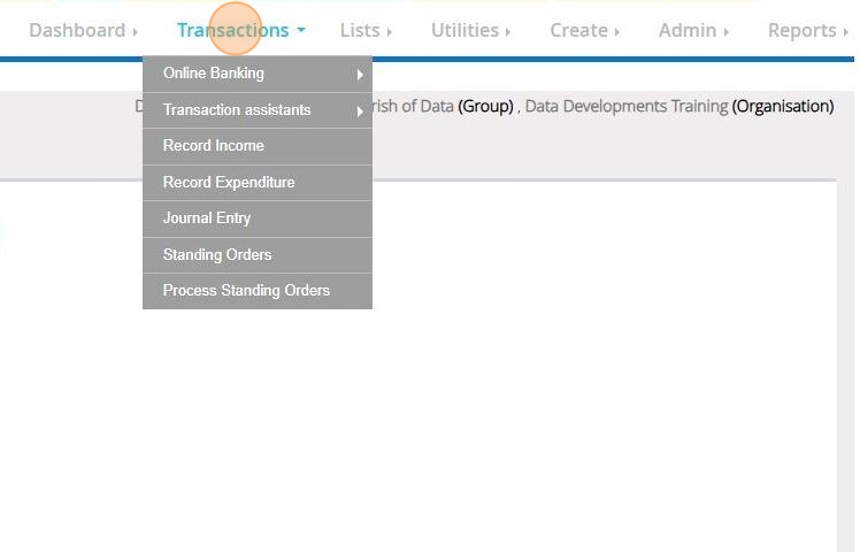

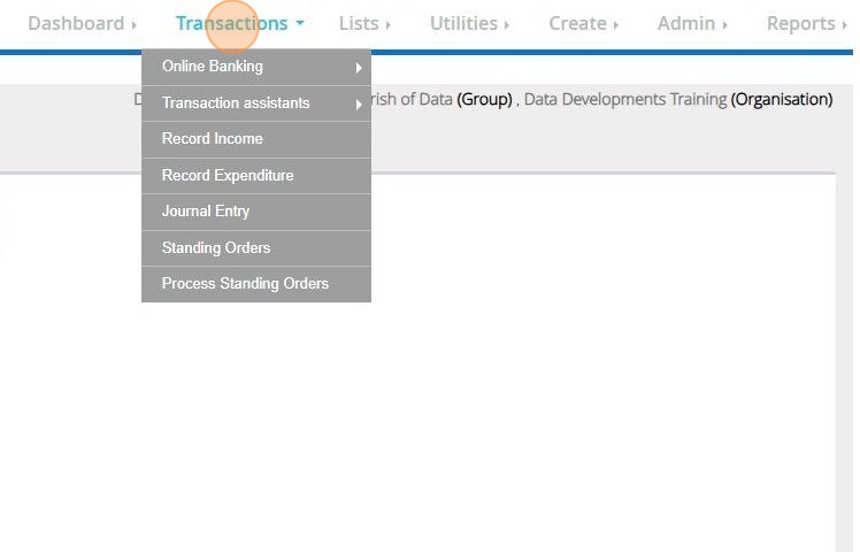

2. Click "Transactions"

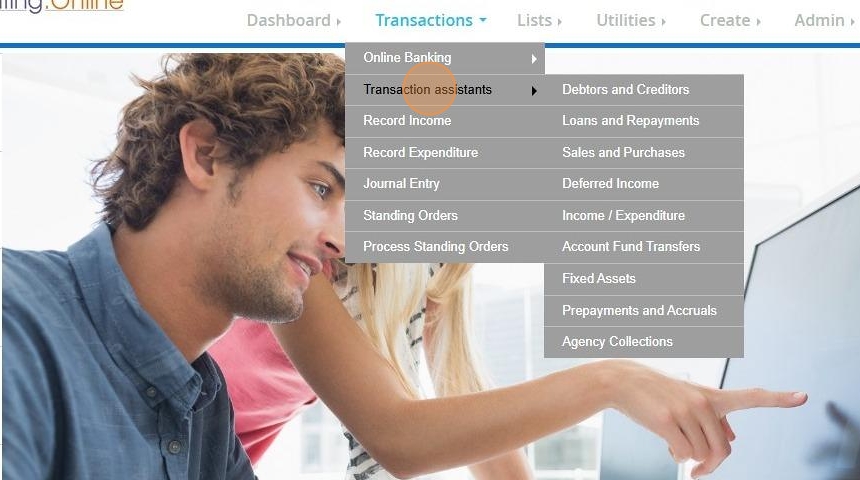

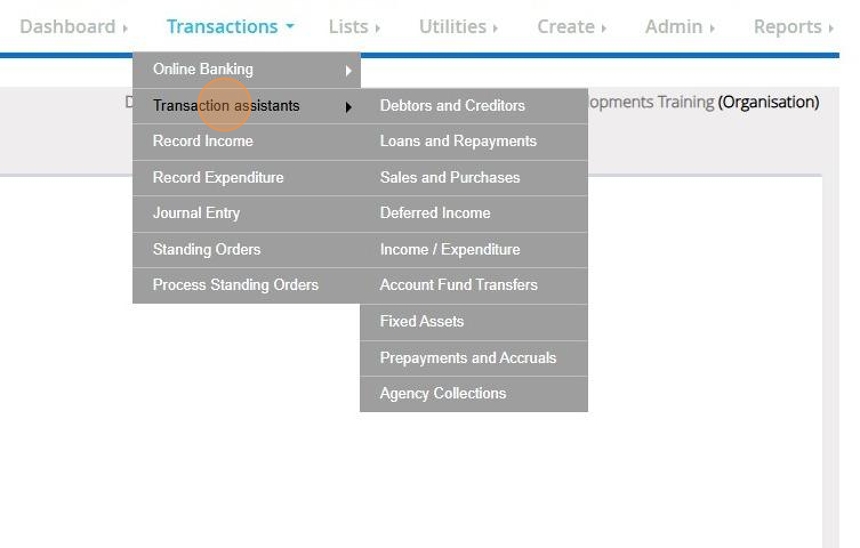

3. Click "Transaction assistants"

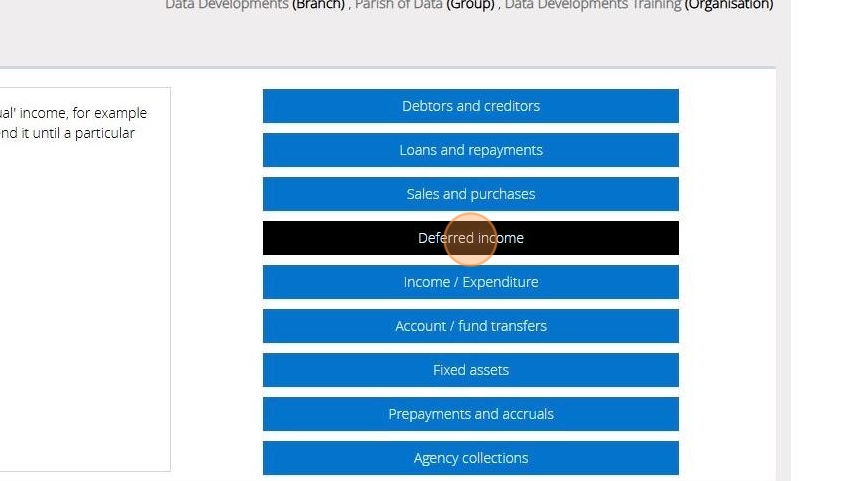

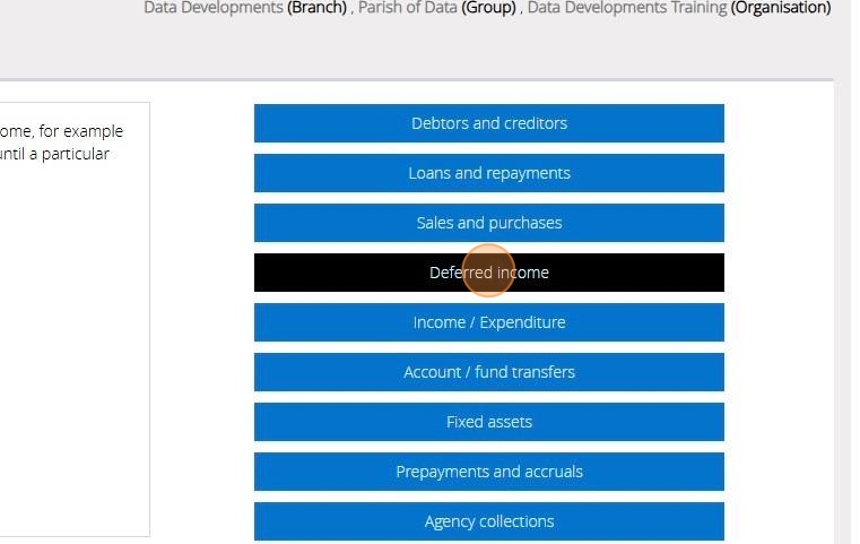

4. Click "Deferred income"

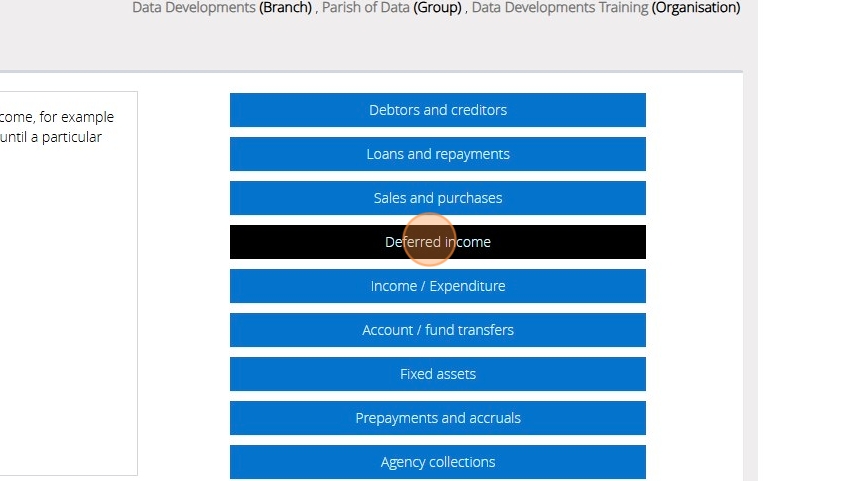

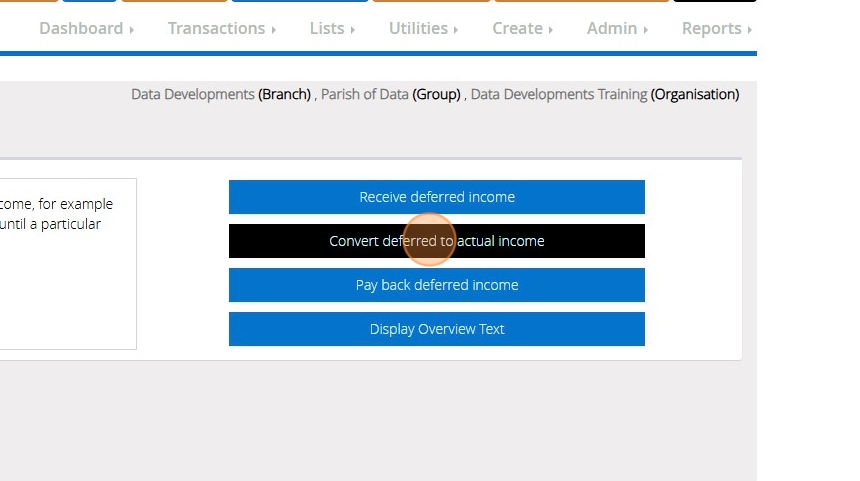

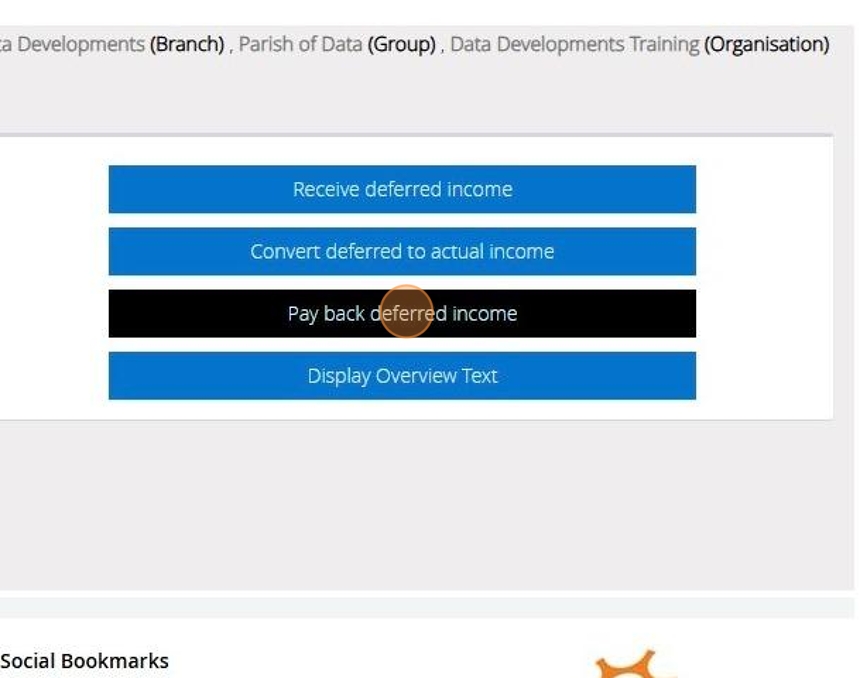

5. Click "Receive deferred income"

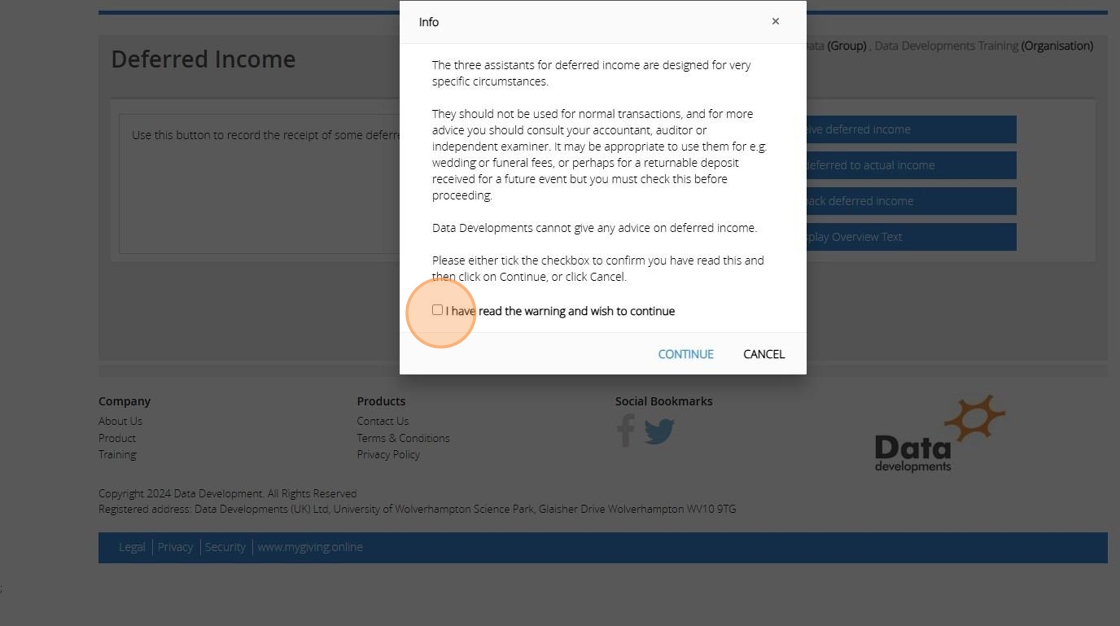

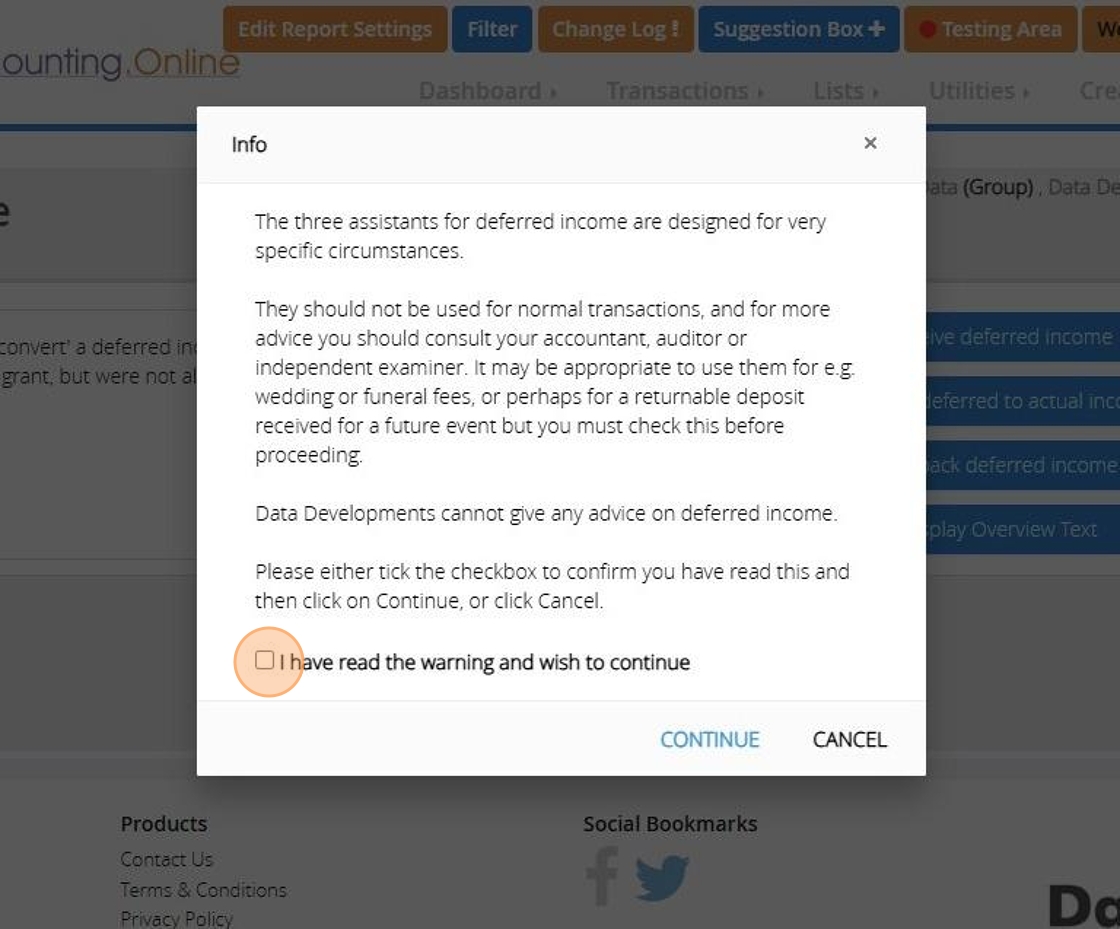

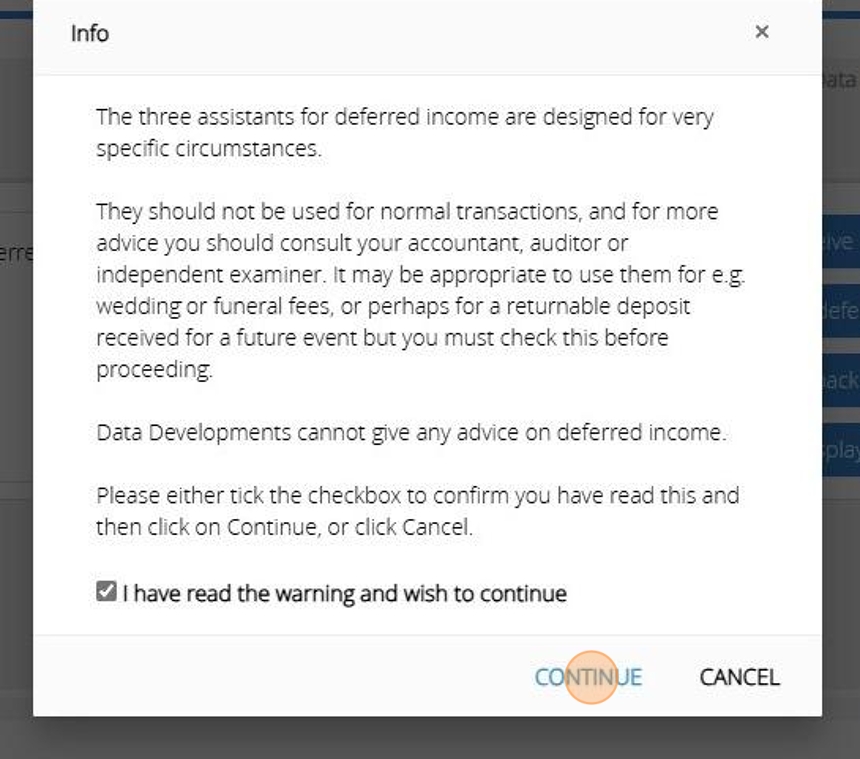

6. Read though the statement and should you wish to proceed tick the check box next to "I have read the warning and wish to continue" and click continue

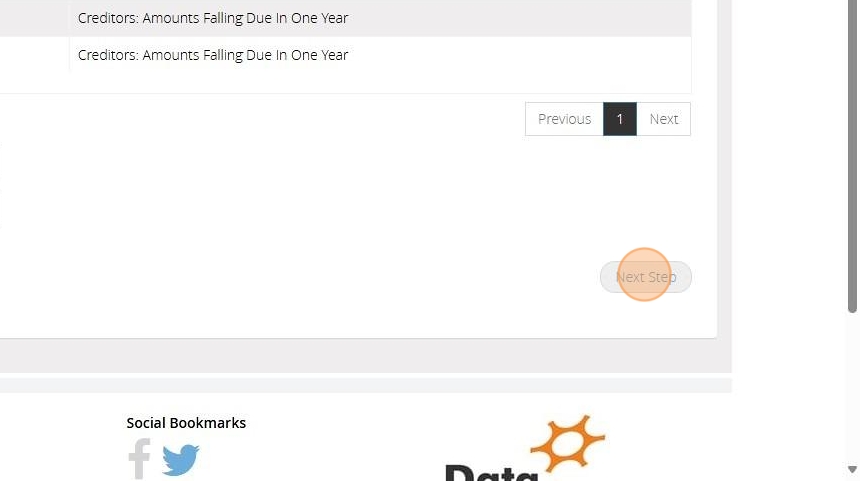

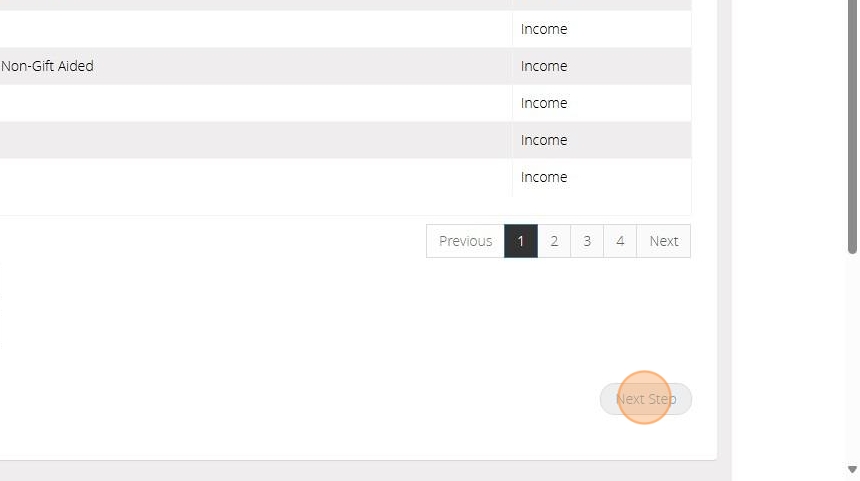

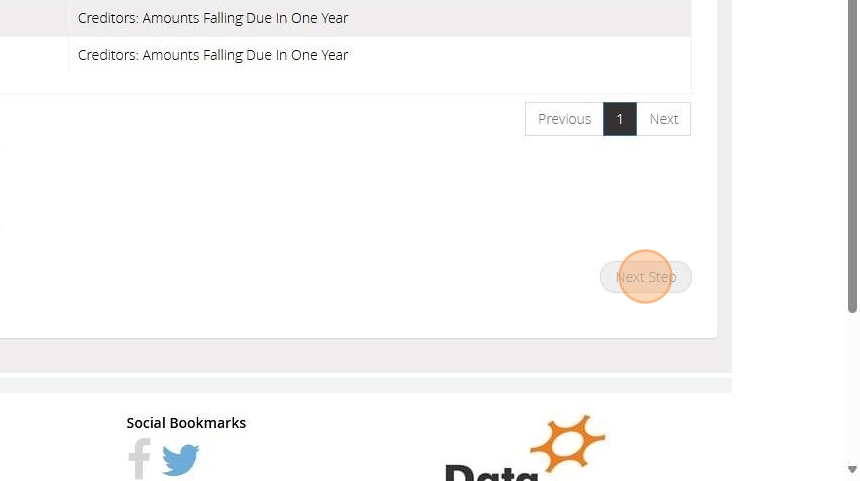

7. On Step 1 Select the Liability code from your list

8. Click "Next Step"

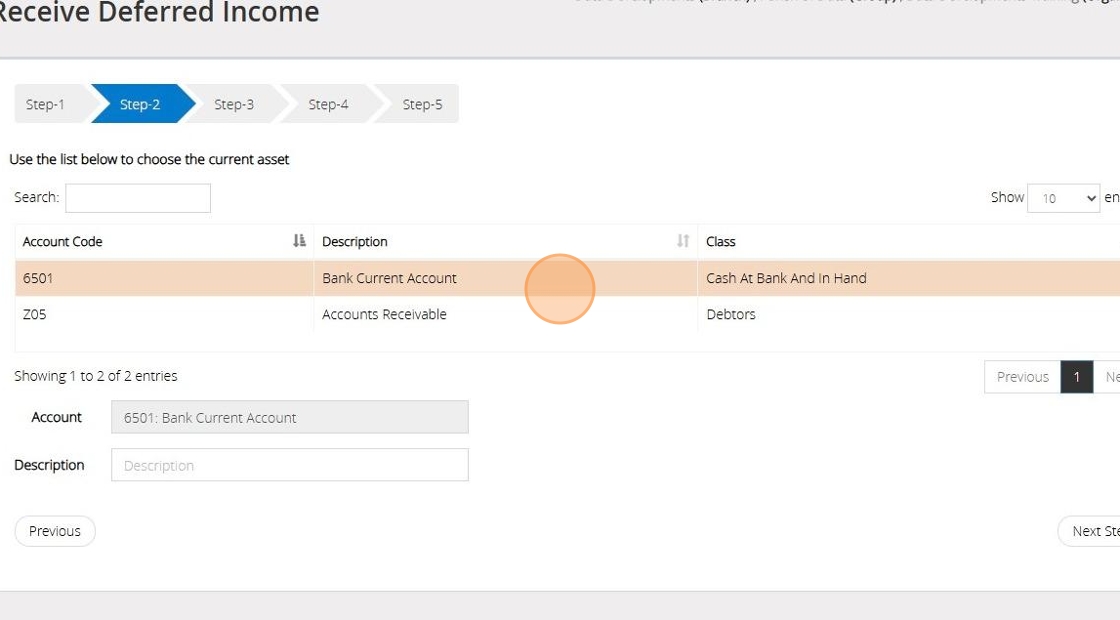

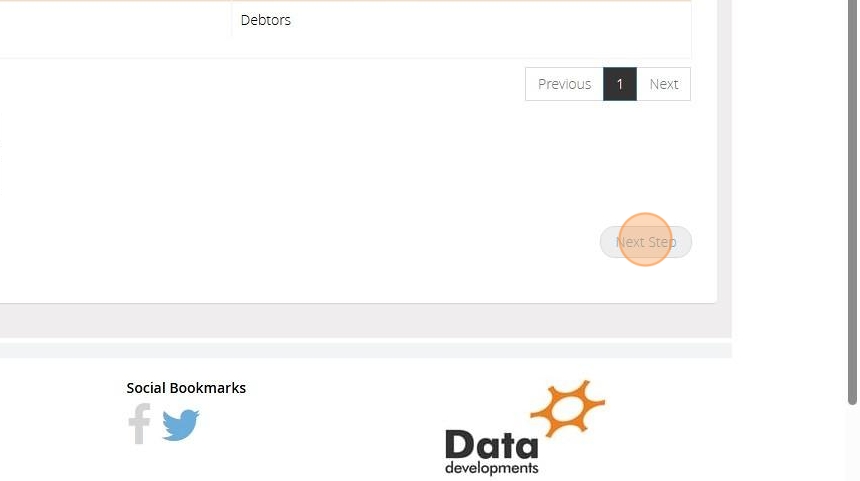

9. On Step 2 select the current asset from your list

10. Click "Next Step"

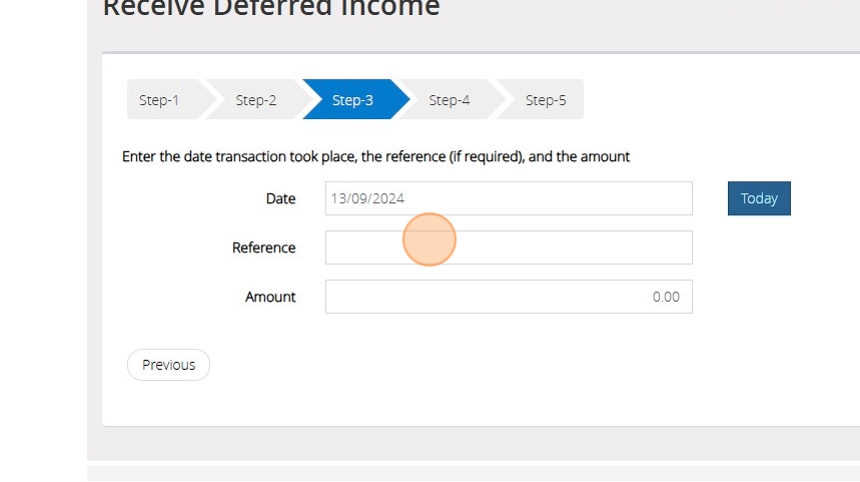

11. In Step 3, input the date, provide a reference, and enter the amount of income you wish to defer.

12. Click "Next Step"

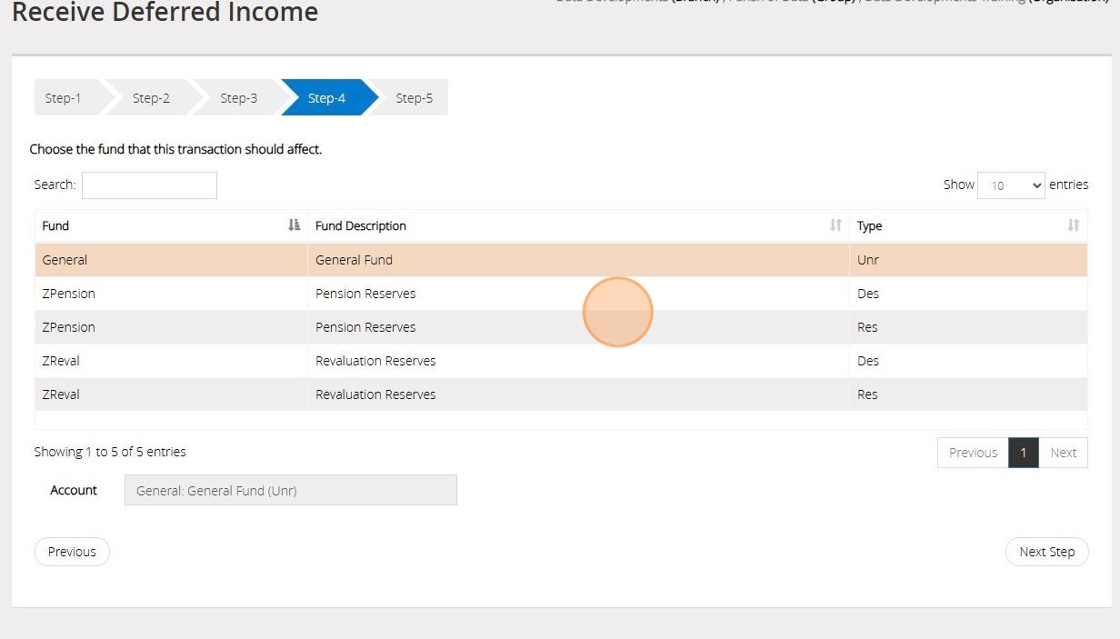

13. On Step 4 Select the fund that this transaction should affect

14. Click "Next Step"

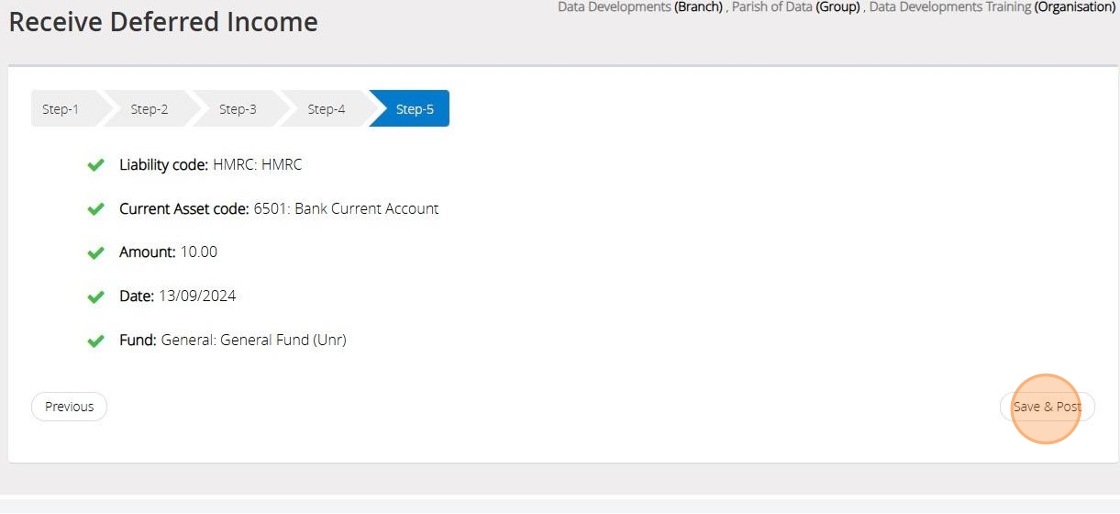

15. On Step 5 confirm the selections that have been made > Once ready click "Save & Post"

Convert deferred to actual income

Tip: The below steps will guide you in converting deferred income to actual income

16. Click "Transactions"

17. Click "Transaction assistants"

18. Click "Deferred income"

19. Click "Convert deferred to actual income"

20. Read though the statement and should you wish to proceed tick the check box next to "I have read the warning and wish to continue" and click continue

21. On Step 1 select the income code to be used

22. Click "Next Step"

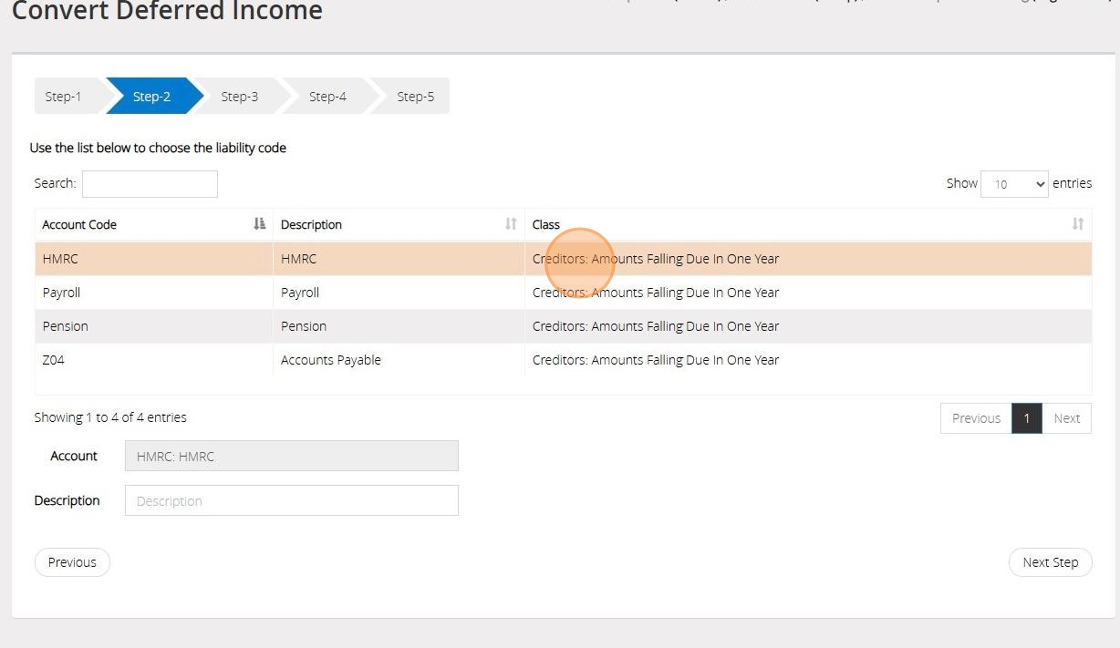

23. On Step 2 select the liability code you used when recording the deferred Income in Step 7

24. Click "Next Step"

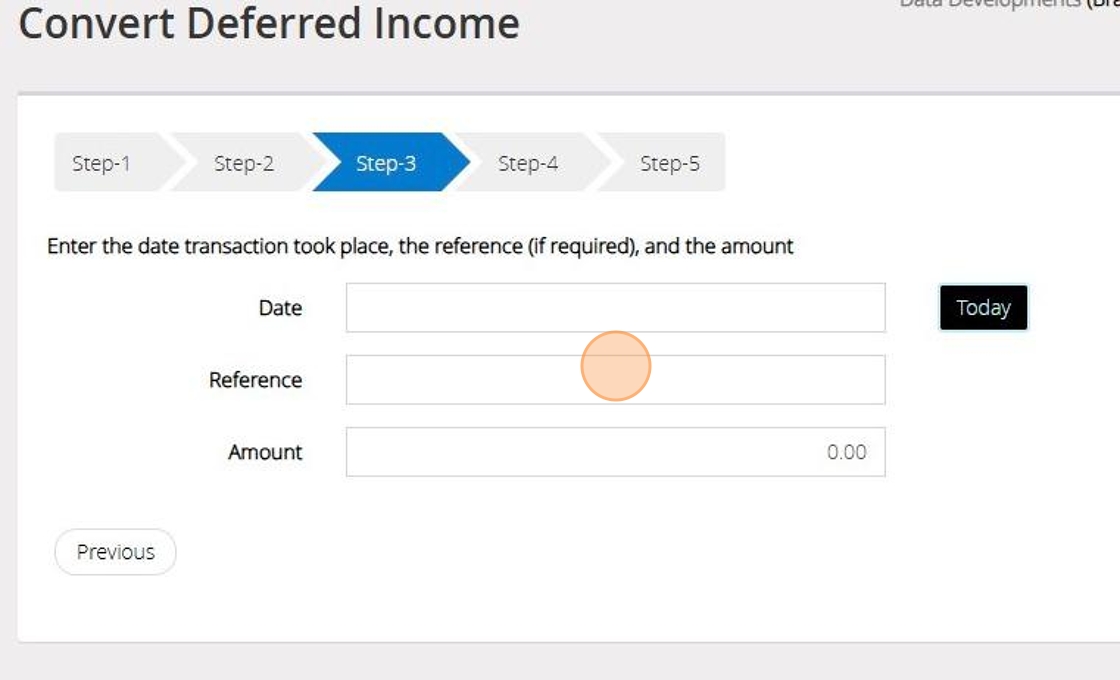

25. In Step 3, input the date (this can be the date the service was provided or any date within the year the service took place), provide a reference, and enter the amount of deferred income you wish to convert

26. Click "Next Step"

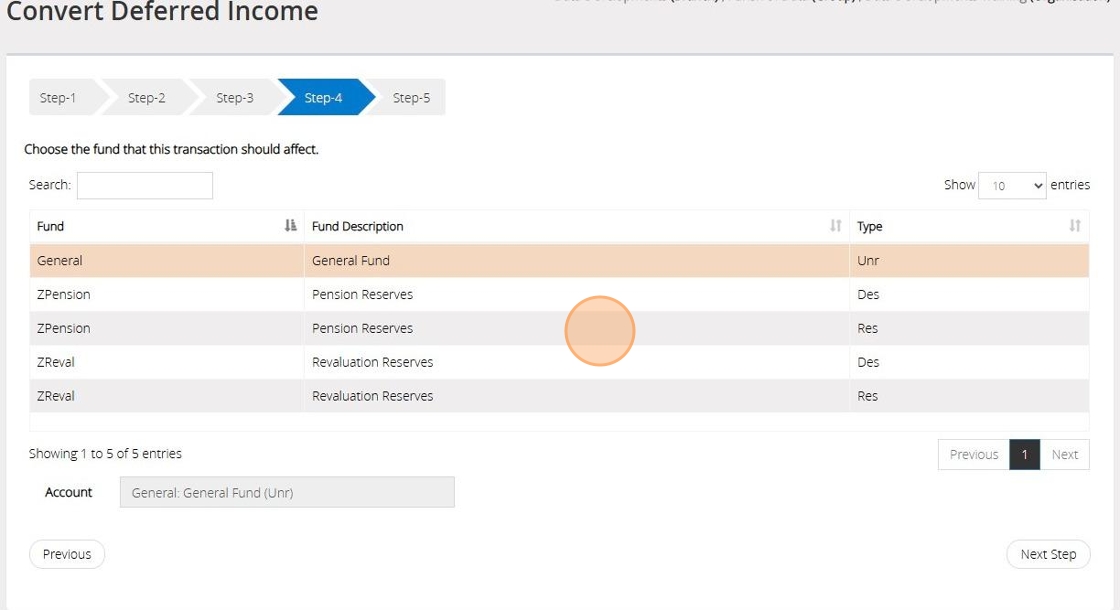

27. On Step 4 Select the fund that this transaction should affect

28. Click "Next Step"

29. On Step 5 confirm the selections that have been made > Once ready click "Save & Post"

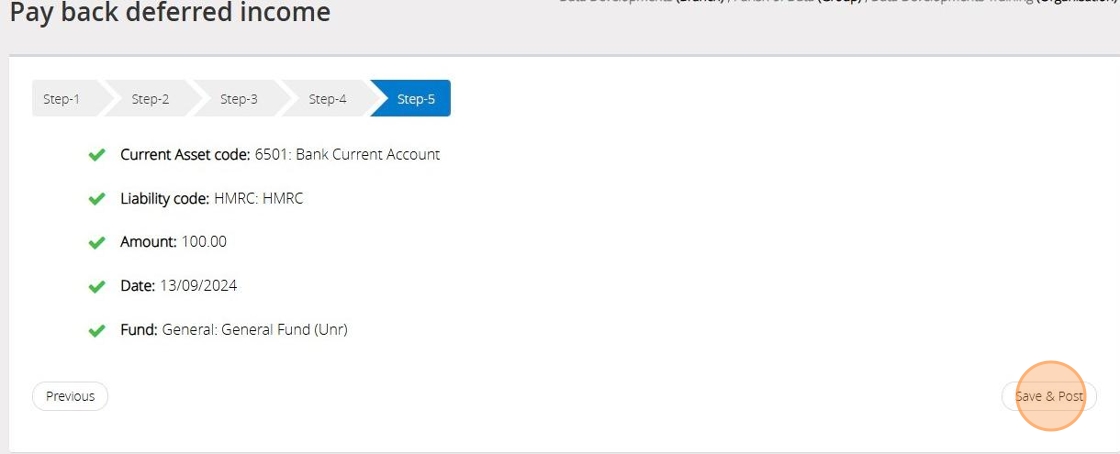

Pay Back Deferred Income

Tip: You may experience a situation where an amount of deferred income has to be paid back and never becomes actual income. The below steps will guide you in removing the deferred income from your accounts.

30. Click "Transactions"

31. Click "Transaction assistants"

32. Click "Deferred income"

33. Click "Pay back deferred income"

34. Read though the statement and should you wish to proceed tick the check box next to "I have read the warning and wish to continue" and click continue

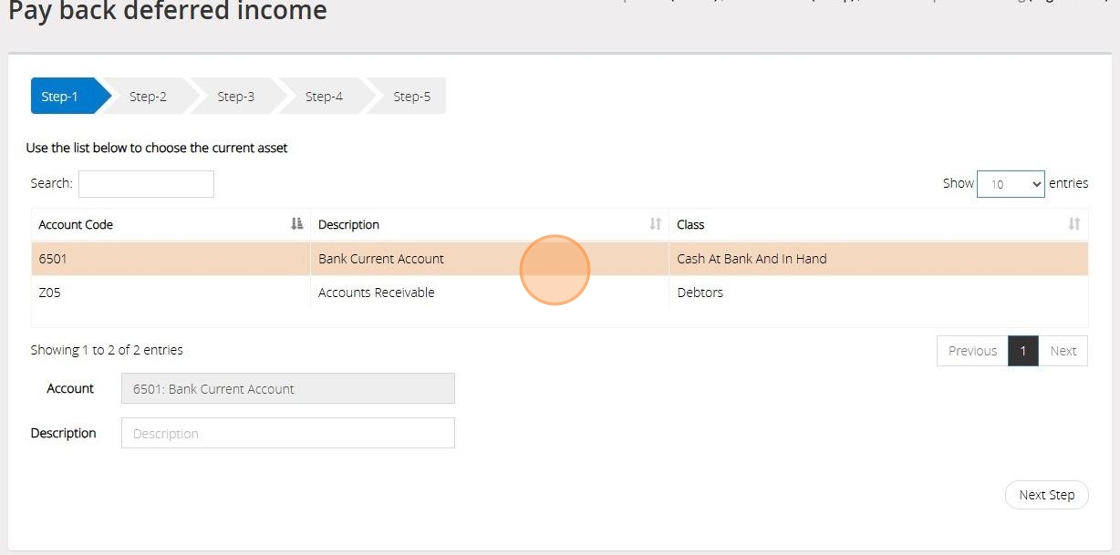

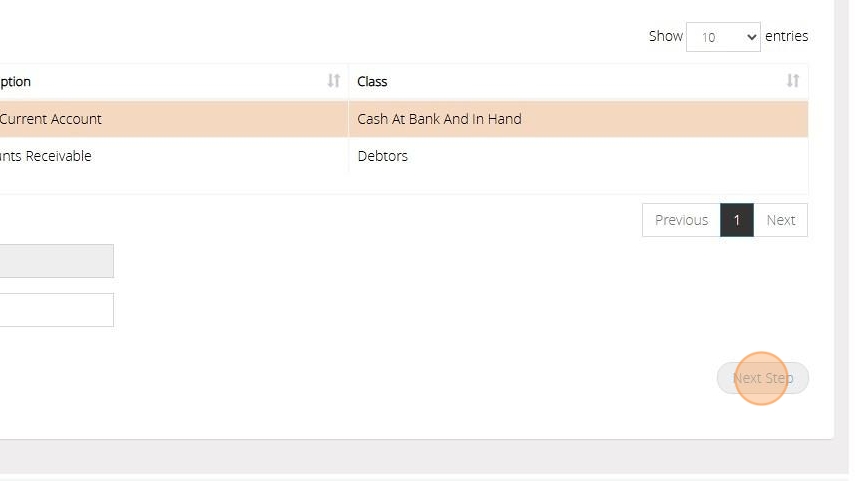

35. On Step 1 select the current asset

36. Click "Next Step"

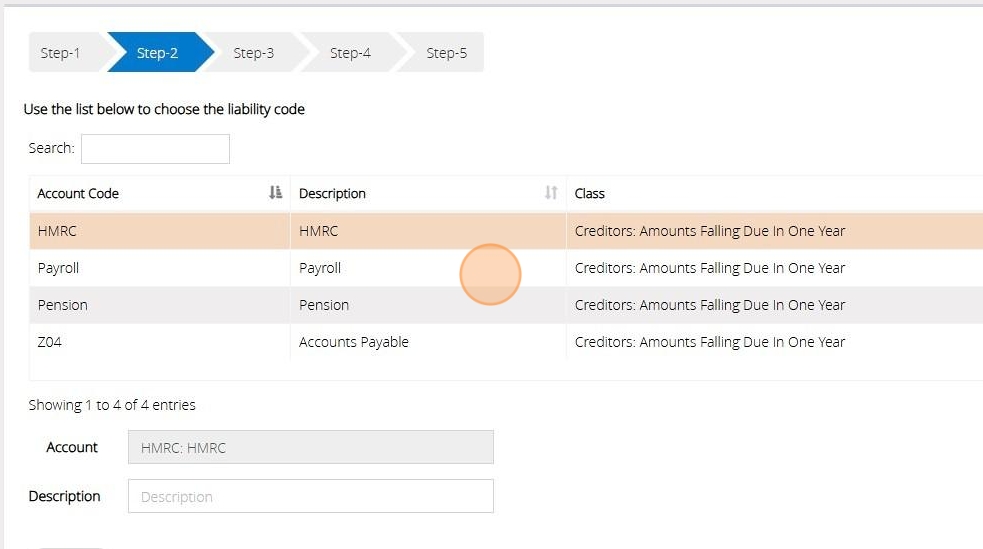

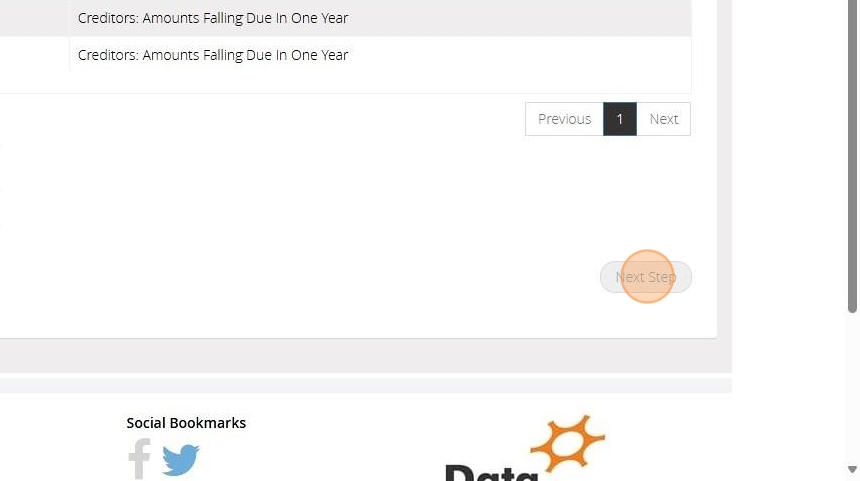

37. On Step 2 select the liability code you used when recording the deferred Income in Step 7

38. Click "Next Step"

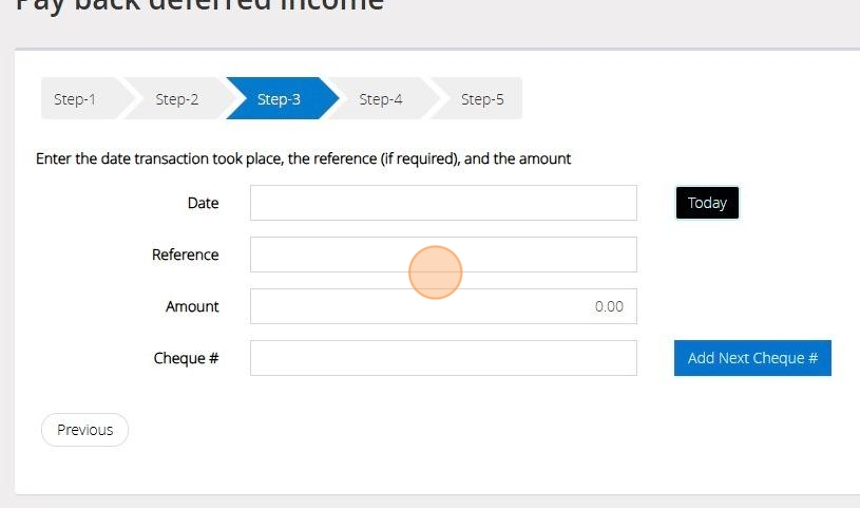

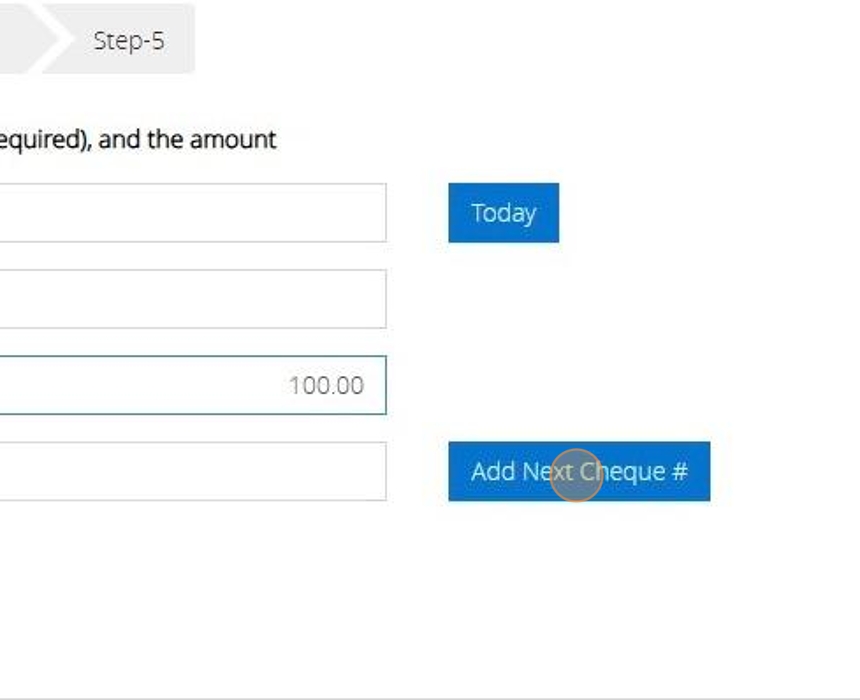

39. In Step 3, input the date, provide a reference, and enter the amount of money that has been paid back

40. If a cheque was issued Click "Add Next Cheque" to auto-fill the subsequent cheque number.

41. Click "Next Step"

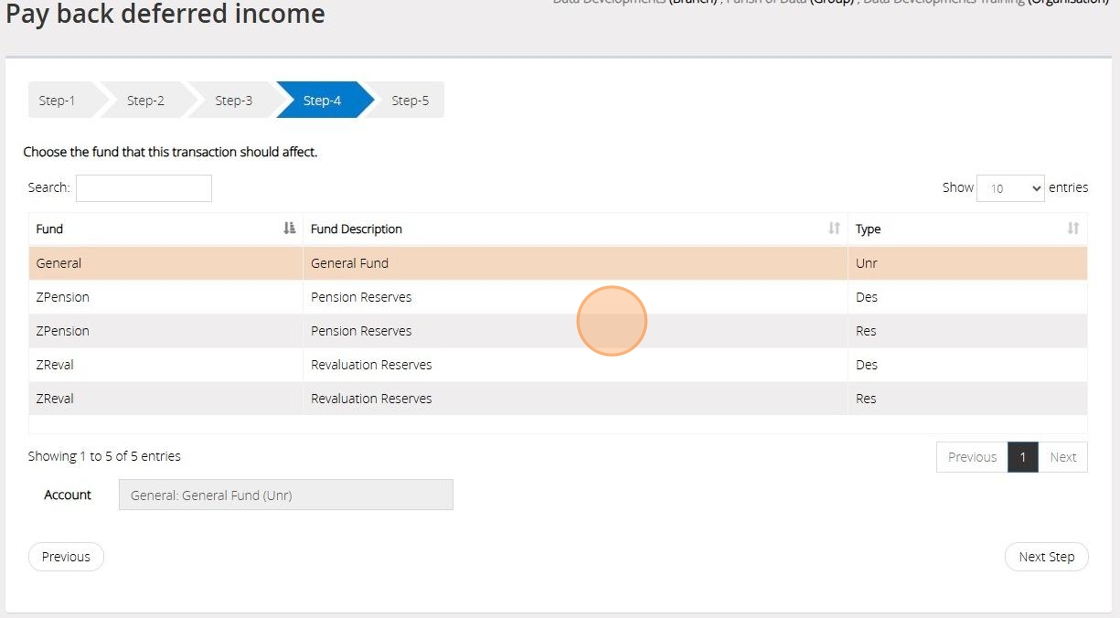

42. On Step 4 Select the fund that this transaction should affect

43. Click "Next Step"

44. On Step 5 confirm the selections that have been made > Once ready click "Save & Post"