The following steps will assist you in managing loans and repayments.

Loan from a third party - A loan from a third party such as the bank should be recorded using the below steps. The balance will be allocated to a liability account as you owe money to a third party.

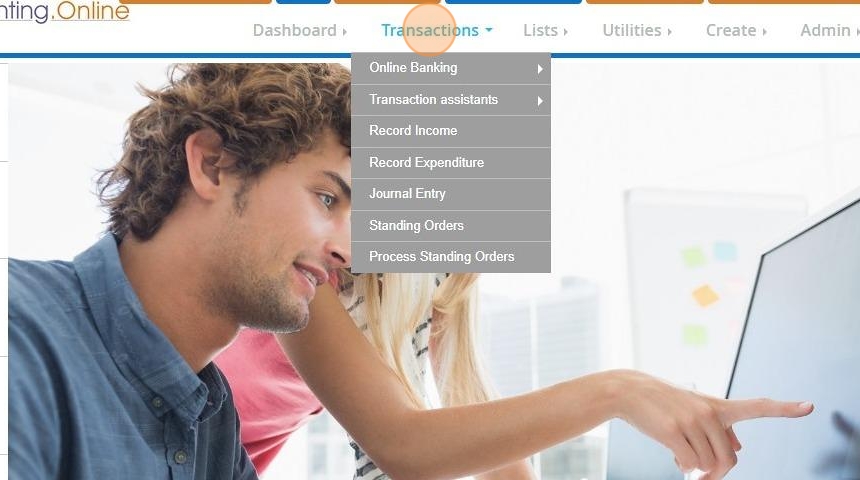

1. Navigate to https://www.myfundaccounting.online

2. Click "Transactions"

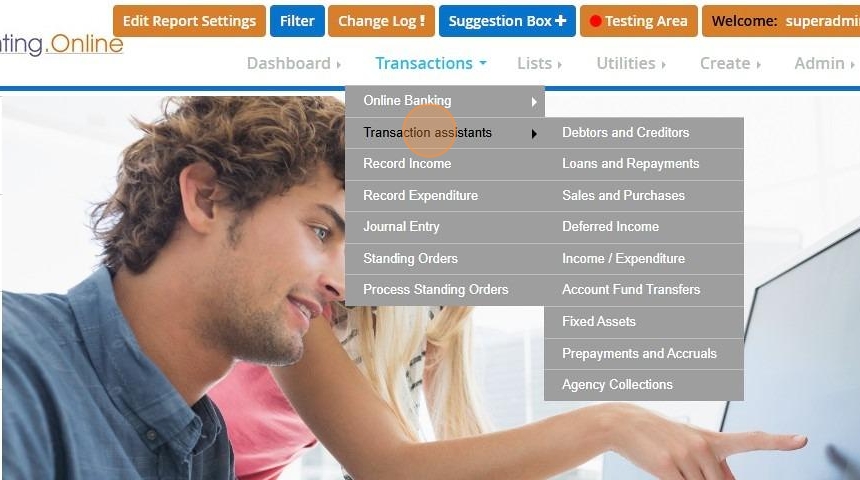

3. Click "Transaction assistants"

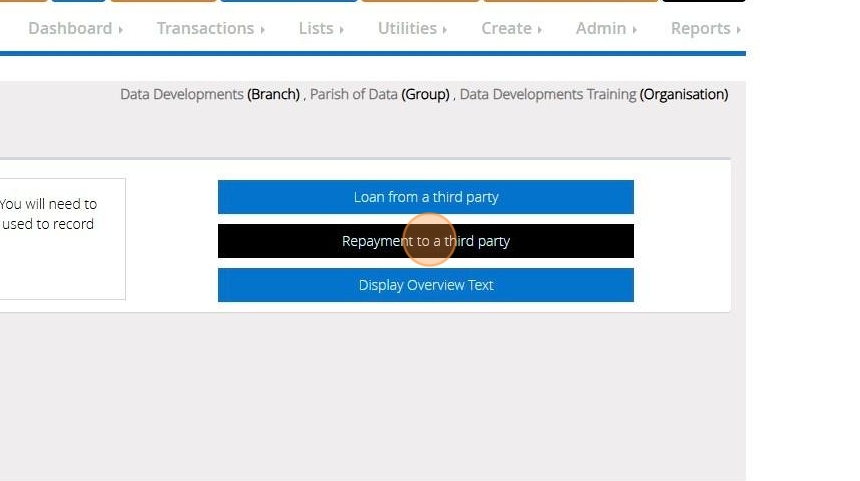

4. Click "Loans and repayments"

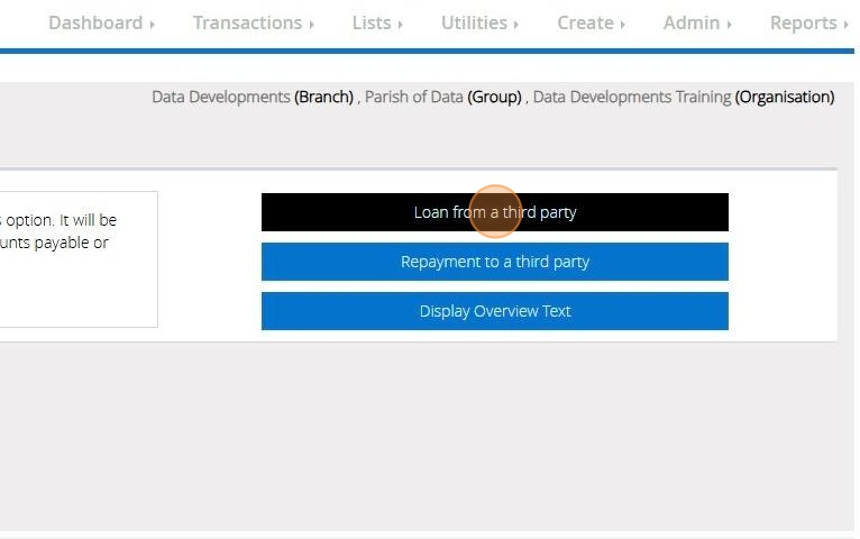

5. Click "Loan from a third party"

6. On Step 1 select the liability code

Tip: Tip! Accounts payable or Loans received are accounts that could be used.

7. Click "Next Step"

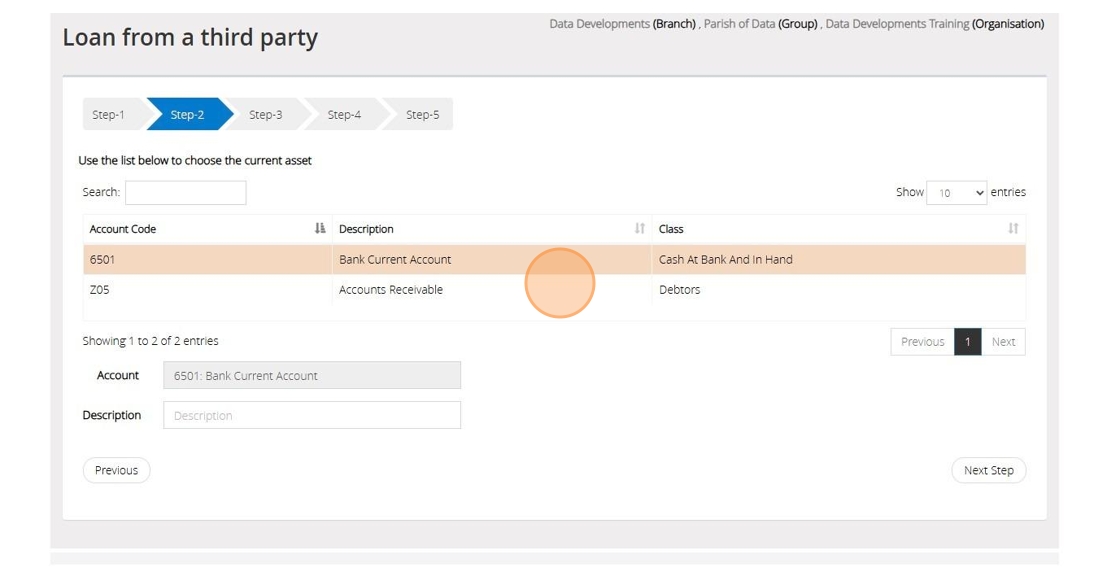

8. In Step 2, choose the current asset that you wish to use.

9. Click "Next Step"

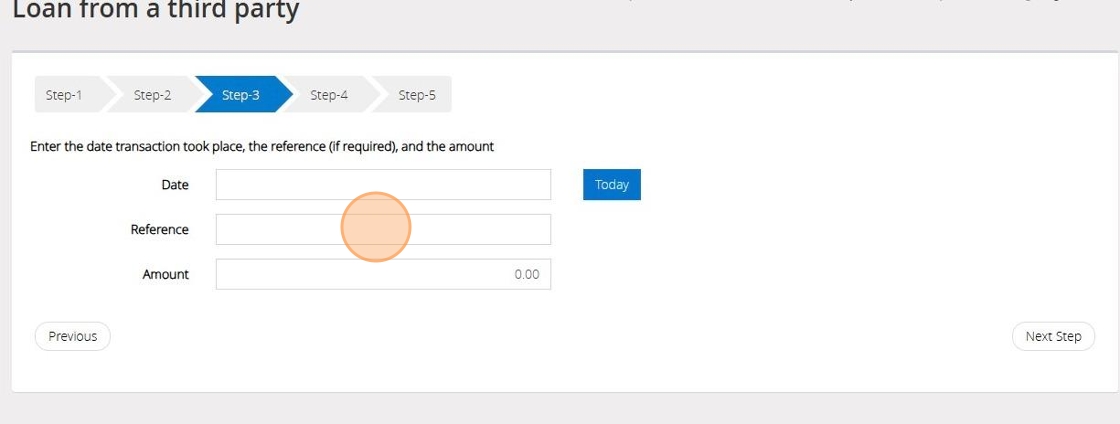

10. In Step 3, input the date, provide a reference, and enter the amount of the loan

11. Click "Next Step"

12. On Step 4 select the fund that the transaction should affect

13. Click "Next Step"

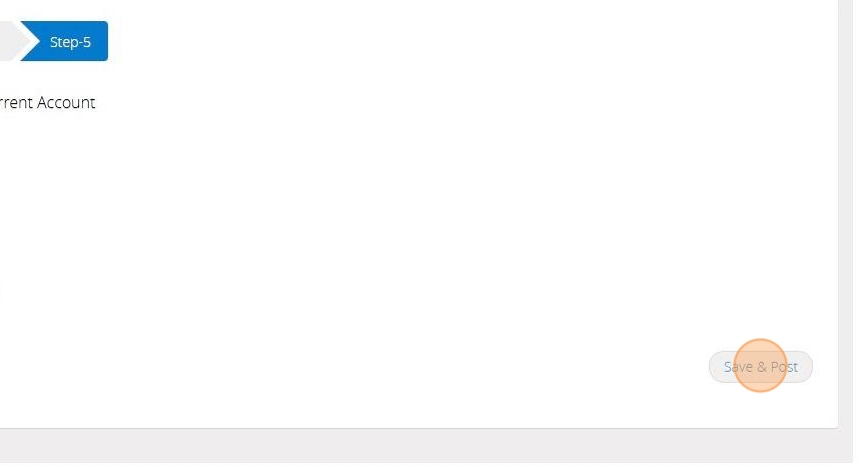

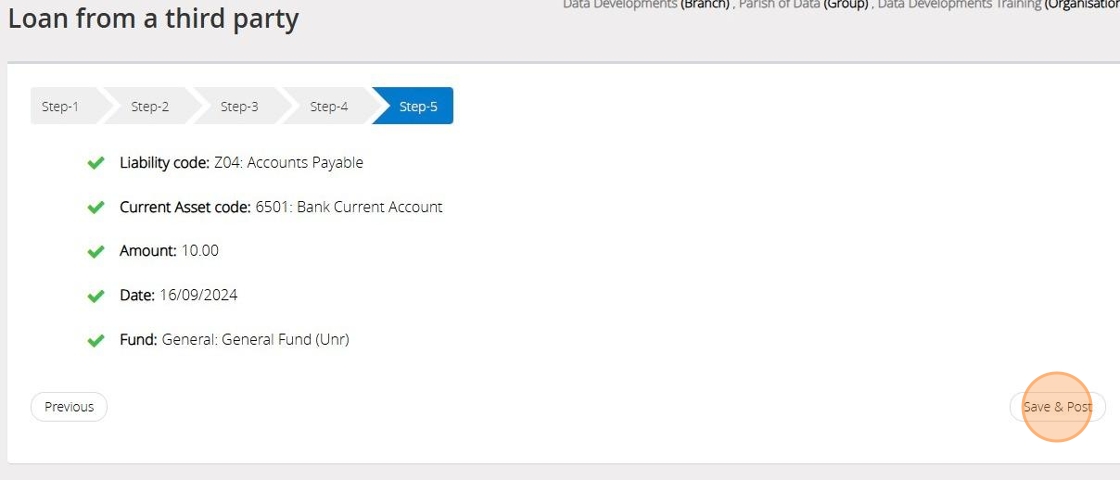

14. On Step 5 confirm the selections that have been made > Once ready click "Save & Post"

Repayment to a third party

Tip: Use the below steps when you need to record that a loan has been repaid partially or in full

15. Click "Loans and Repayments"

16. Click "Repayment to a third party"

17. On Step 1 select the current asset from your list that has been used to repay the loan

18. Click "Next Step"

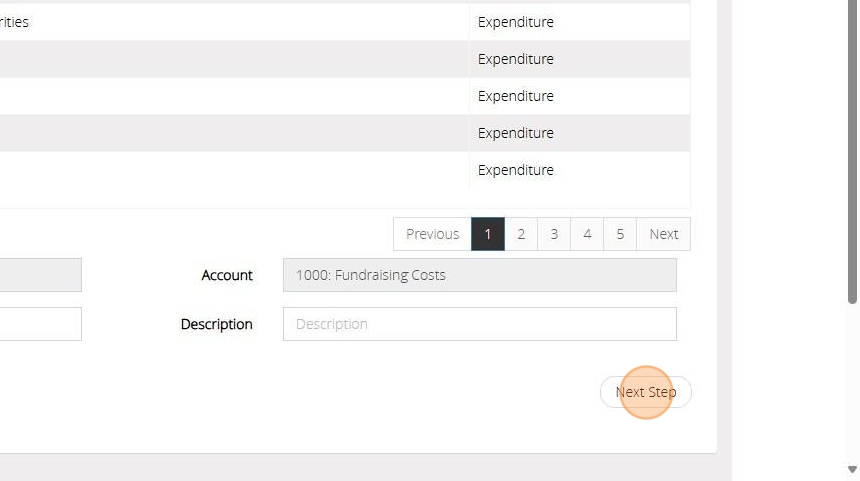

19. On Step 2 in the upper section, select the liability code that should be used to record the capital amount

20. On Step 2 in the lower section select the expenditure code that should be used to record the interest

21. Click " Next Step"

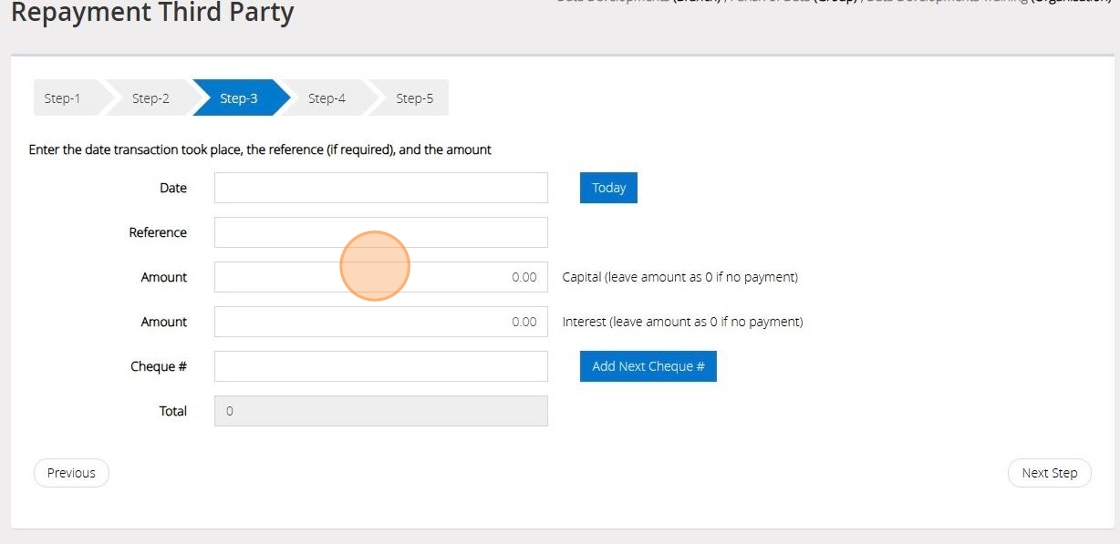

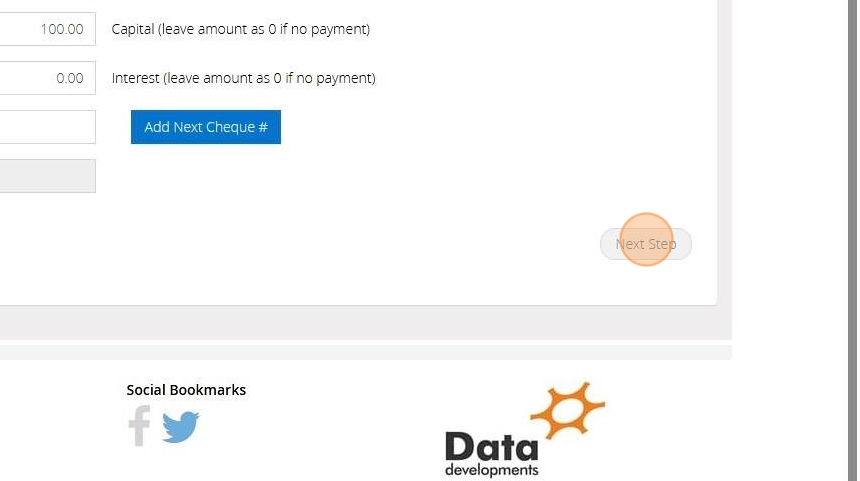

22. On Step 3, Enter the date and a reference. Enter the amount of Capital and the amount of interest

Tip: Tip! If no capital or interest is recorded then leave the amount as 0.00

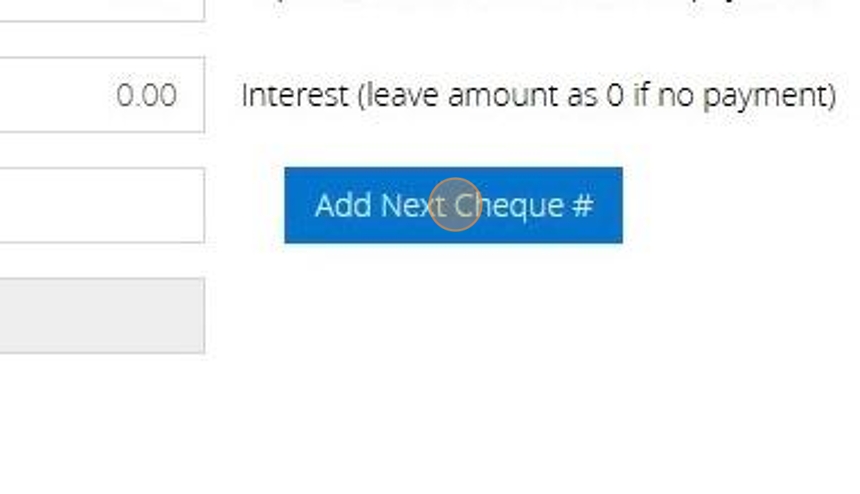

23. If a cheque was issued click "Add Next Cheque" to auto- fil the subsequent cheque number

24. Click "Next Step"

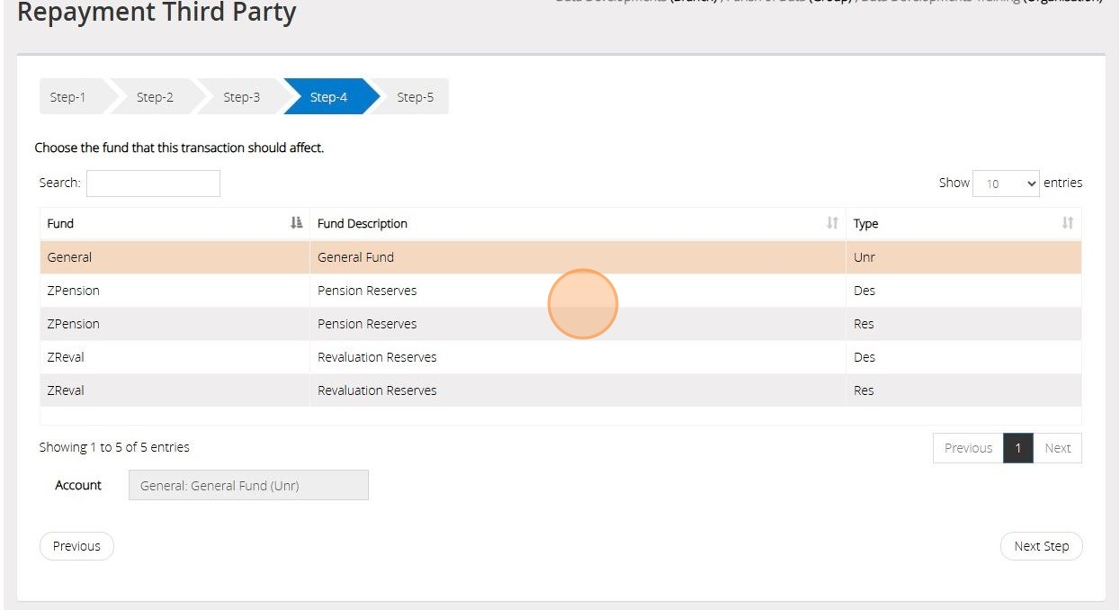

25. On Step 4 select the fund that the repayment should affect

26. Click "Next Step"

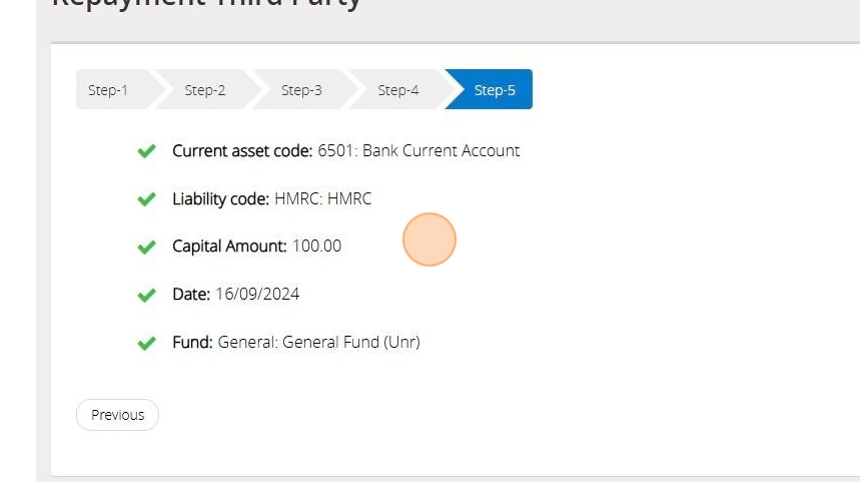

27. On Step 5 confirm the selections that have been made > Once ready click "Save & Post"

28. Click "Save & Post"