Tip: You can 'Aggregate' (or add together) donations of £20 or less from different donors without having to submit all the donor details to the HMRC.

An example of this would be if you have a Baptism service and a number of donor's make a donation and fill in the Gift Aid envelope declaration

Tip: For all donations that are £20 or less, instead of having to create a donor record for each individual donation you can total them all together for this event, and record it as one aggregated donation.

The total donations must not exceed more than £1,000 and you MUST keep all the envelope declarations as this is your audit trail.

The below steps will guide you in entering an Aggregated Donation

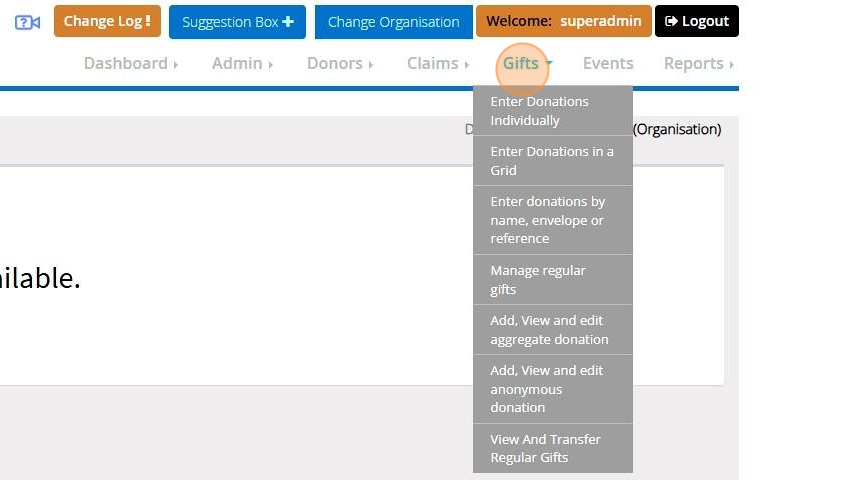

1. Click "Gifts"

2. Click "Add, View and edit aggregate donation"

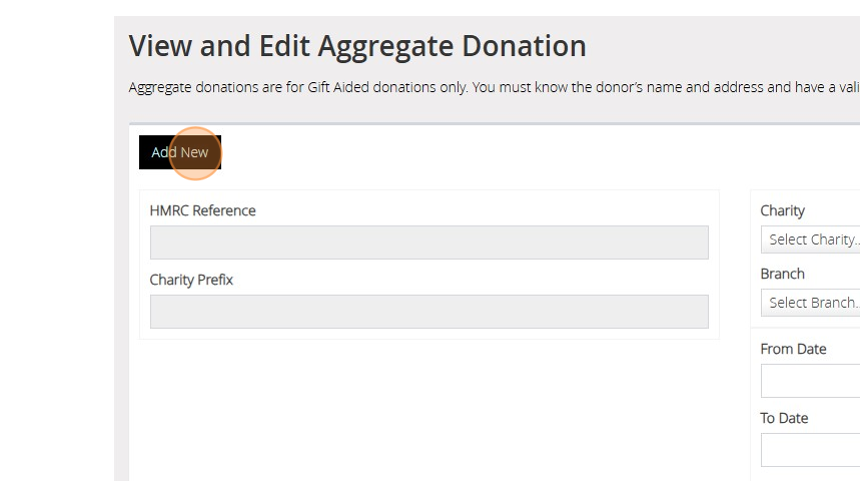

3. Click "Add New"

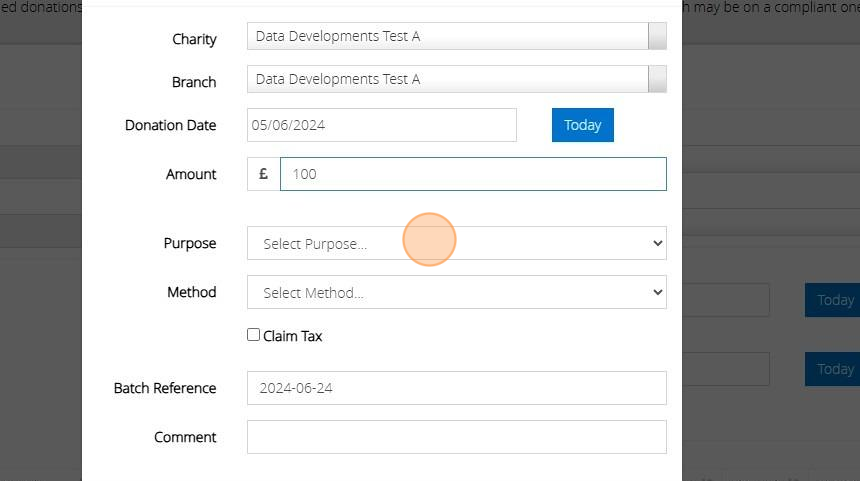

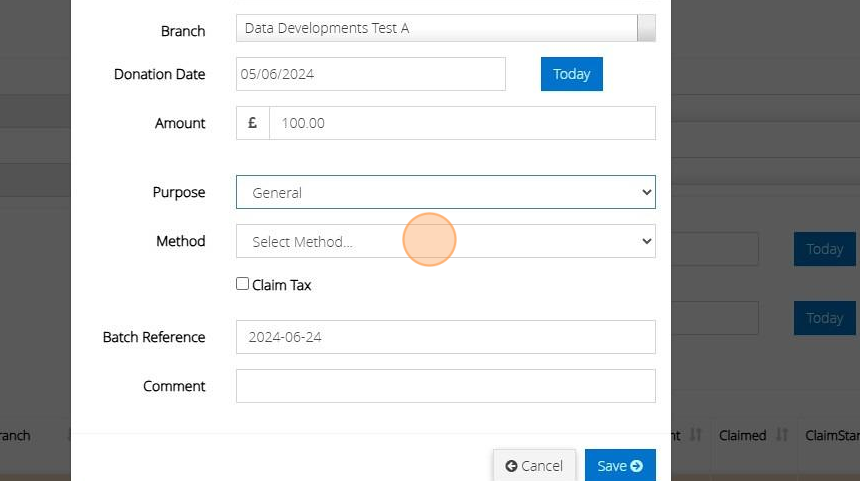

4. Enter the "Donation Date"

5. Enter the Total Amount of your aggregated donations.

6. Select the Purpose

7. Select the Method

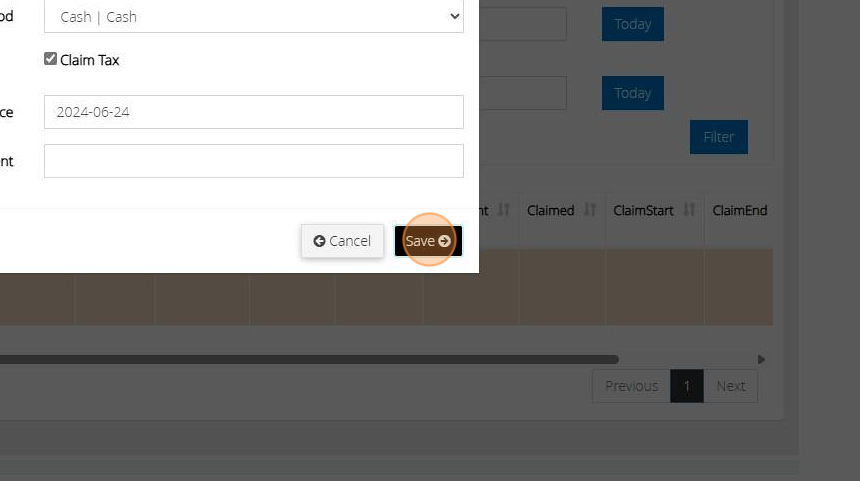

8. Tick the box to claim tax.

9. Click "Save"