Tip: The following steps will assist you in correcting a GASDS Claim that has already been submitted to HMRC.

1. Navigate to https://www.mygiving.online/

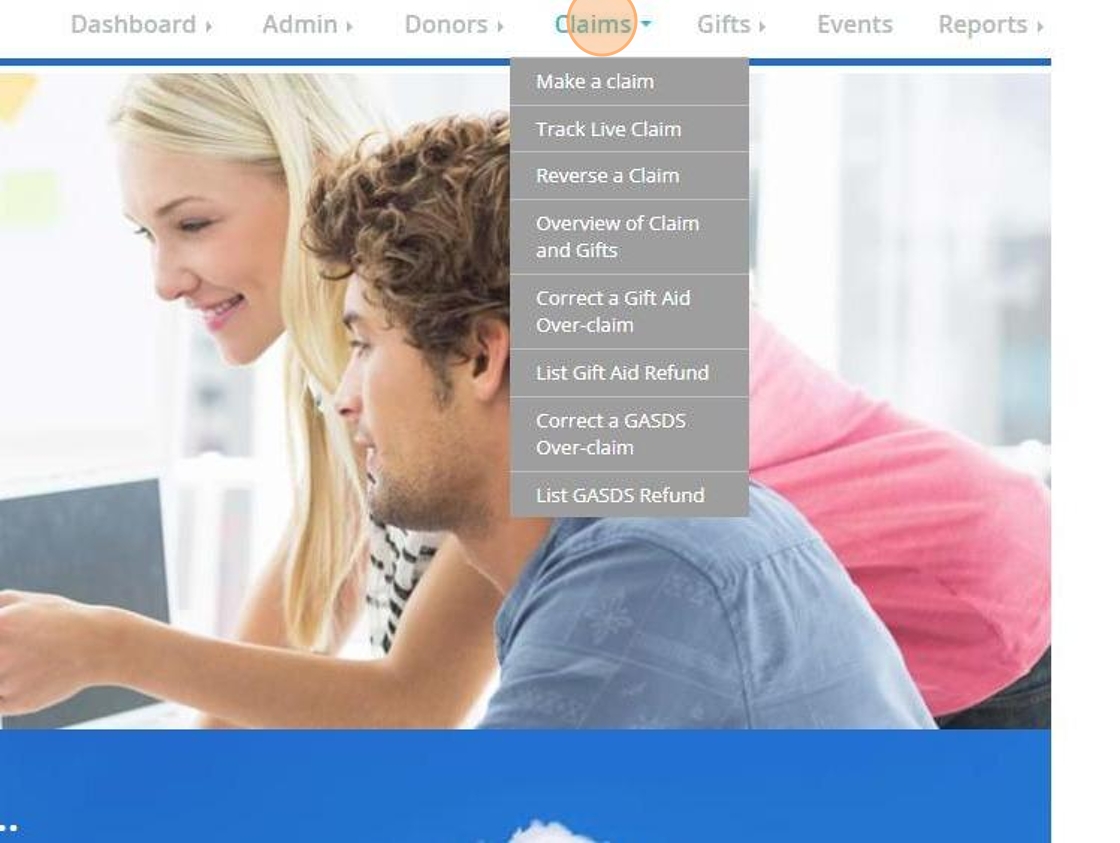

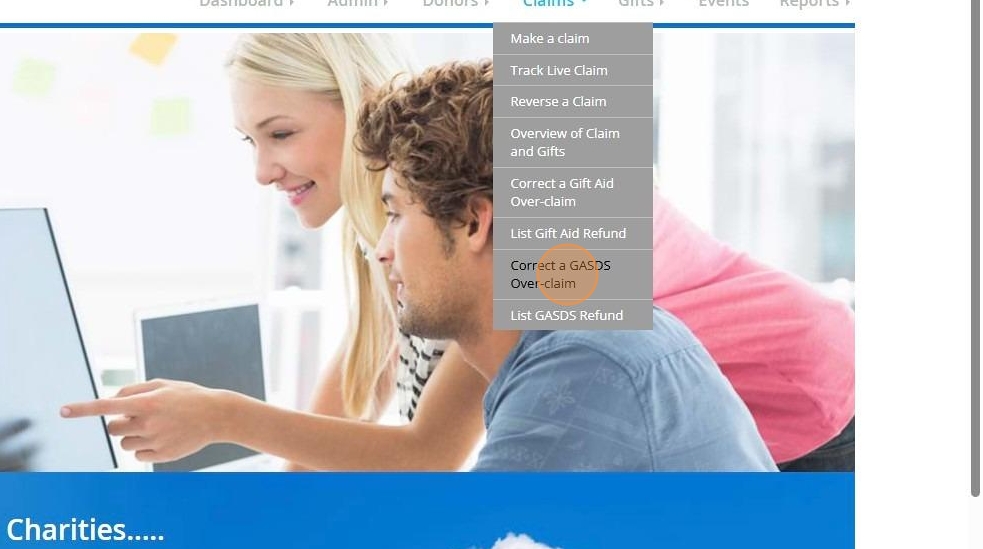

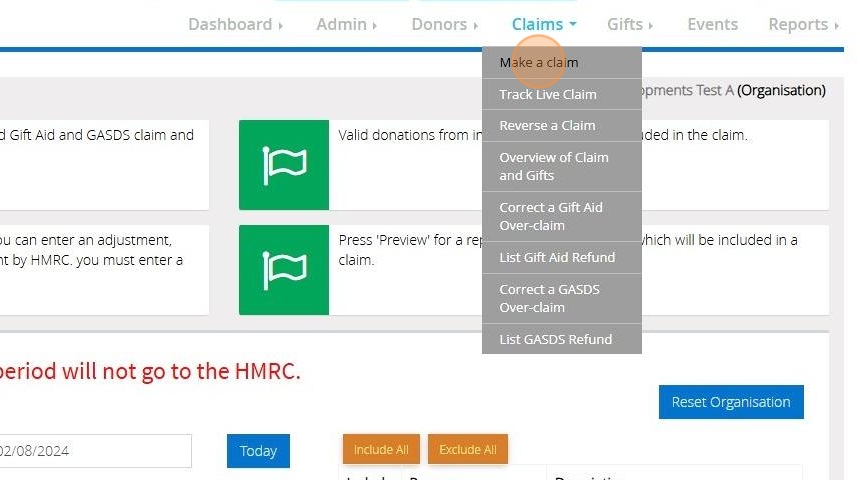

2. Click on "Claims"

3. Click "Correct a GASDS Over-claim"

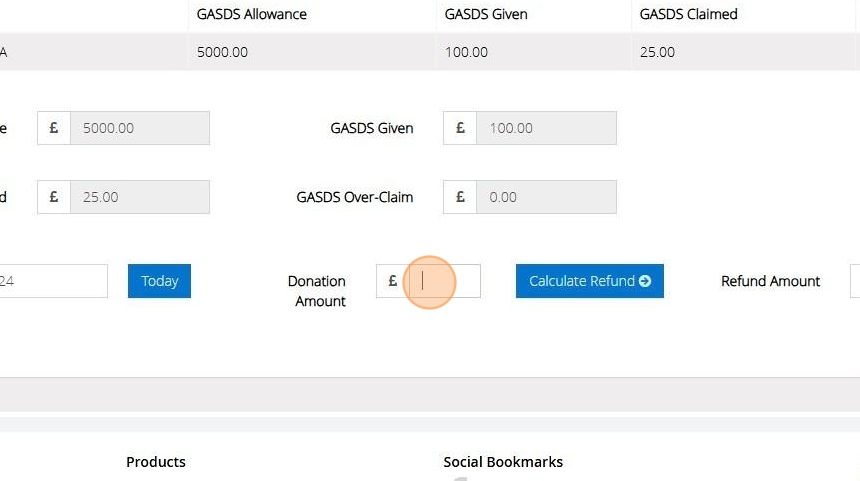

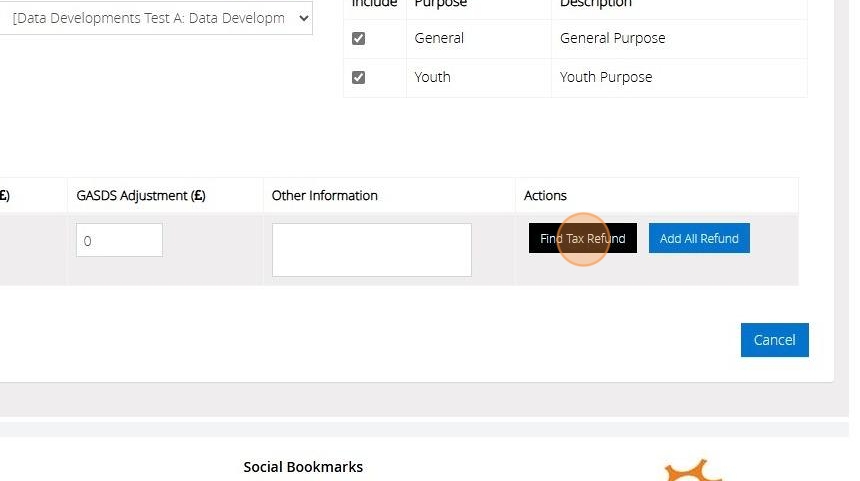

4. Select your charity from the drop down bar

5. Select your branch from the drop down bar

6. Enter the date of the correction. This must be within the Tax year the refund needs to be recorded for

7. Enter the amount given

8. Click "Calculate Refund"

9. The amount that will be refunded to the HMRC will be displayed here

10. Click "Process tax refund"

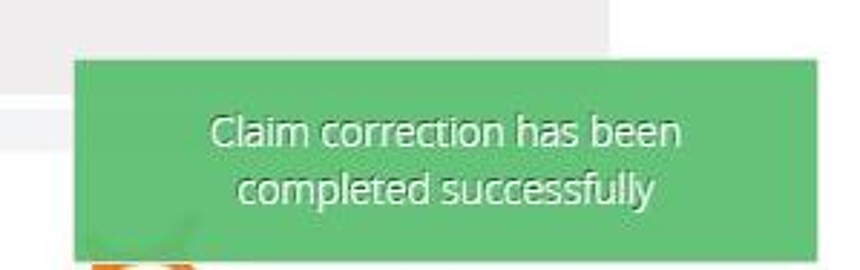

11. Once the refund has been processed the below message will display

Assign a refund to your claim

12. Click "Claims"

13. Click "Make a claim"

14. Click "Submit a claim to HMRC"

15. Click "Find Tax Refund"

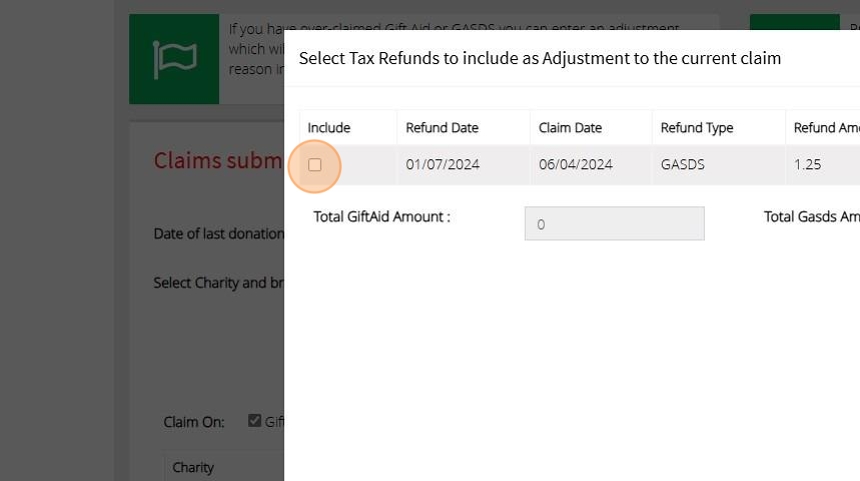

16. Click the checkbox next to your GASDS refund

17. Click "Ok"

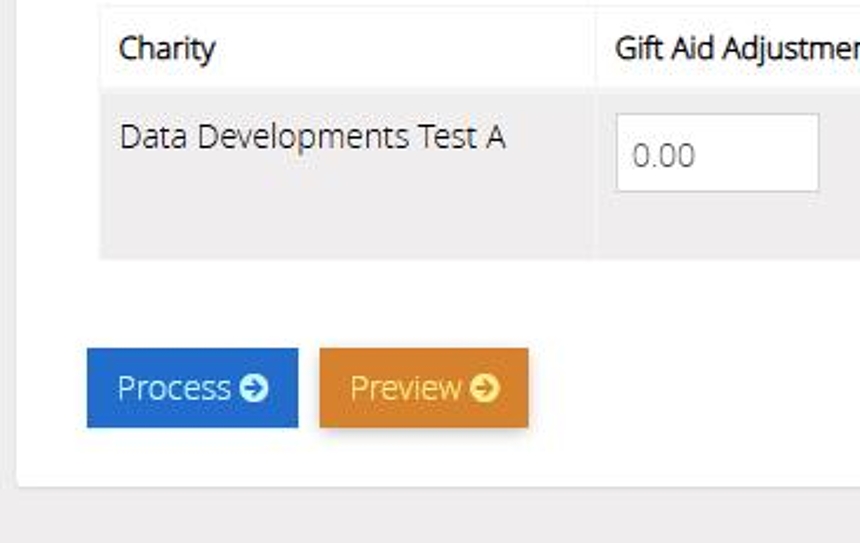

18. You may continue to submit your claim to the HMRC with your refund attached by clicking "Process"