Within MyGiving.Online you can record gifts which do not come from a known donor. Gifts of this type are not eligible for Gift Aid, however, anonymous cash gifts may be eligible for the Gift Aid Small Donations Scheme (GASDS). These are usually donations that have been made via a loose plate or bucket collections.

1. Navigate to https://www.mygiving.online

2. Click "Gifts"

3. Click "Add, View and edit anonymous donation"

4. Click "Add New"

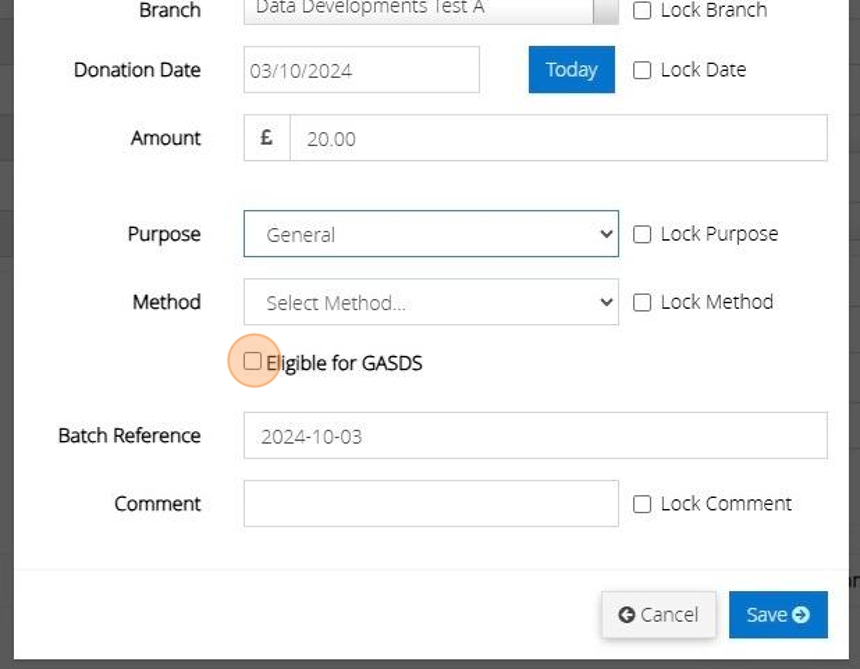

5. Confirm your Charity and Branch by selecting them from the drop drown menus. If you have just the one Charity and Branch they will be automatically selected for you

Tick the "Lock" option to the left of your selection to retain your choice when you go to input your next donation after saving this one.

6. Enter the date of the donation.

Click "Today" to enter todays date.

Tick next to "Lock Date" to retain the date on your next input

Tip! You will see at the top of the screen, the 'tax year' box will show the tax year that this date falls in, and the GASDS entered boxes will reflect the amount that has already been entered for that tax year so you can keep a track as you are entering.

7. Enter the amount of the donation here.

Tip! You can enter the total amount of donations that have been collected as long as each individual donation has been given anonymously and is under £30

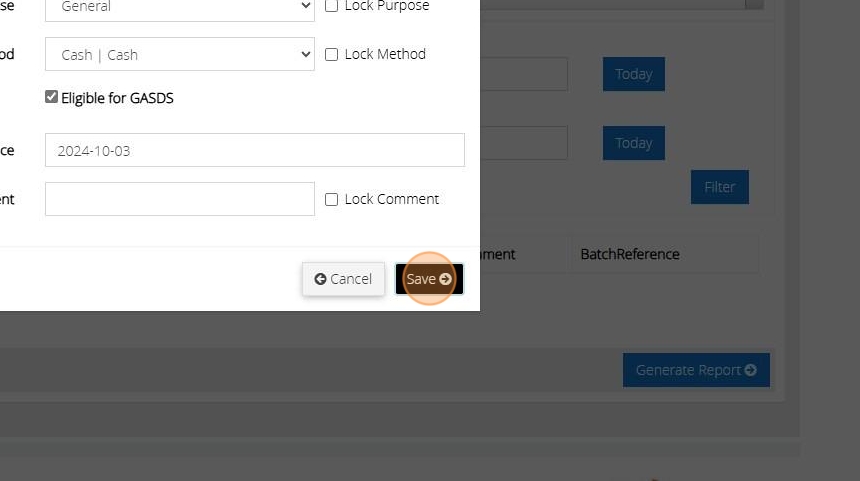

8. Select a "Purpose" and a "Method" from the drop down menus provided.

Click "Lock Purpose" to retain your selection on the next input. You can also lock the Method.

Alert: If the Method selected has not been set up as "can be cash" you will not be able to tick the donation as Eligible for GASDS. For further information please see our guide on "Adding a Method"

9. Tick here to confirm the amount is eligible for GASDS

Alert! If you do not tick to confirm the donation is eligible for GASDS this will not be included within your claim

10. Enter a "Batch Reference" and "Comment"

11. Click "Save"

12. The below message will appear once the donation has been saved successfully.