There are at least two situations when you are required to repay money back to HMRC because you have inadvertently claimed too much

Tip: It may be that you have incorrectly recorded the amount given by the donor, and not noticed the error until after you have made the claim.

For example, the donor may have given £100, and you recorded it as £130.

In this case you need to reduce the donor record by £30, and you need to pay some tax back to HMRC.

Tip: The below steps will guide you through making a Gift Aid Refund

1. Navigate to https://www.mygiving.online

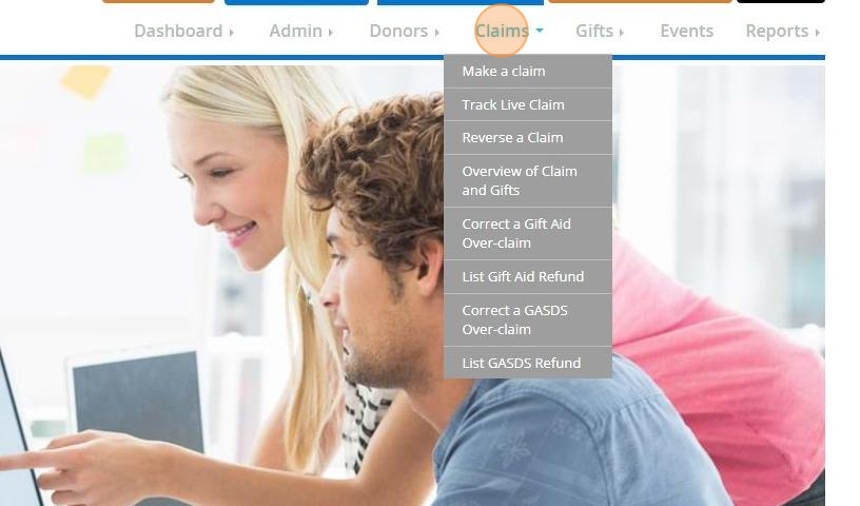

2. Click "Claims"

3. Click "Correct a Gift Aid Over-claim"

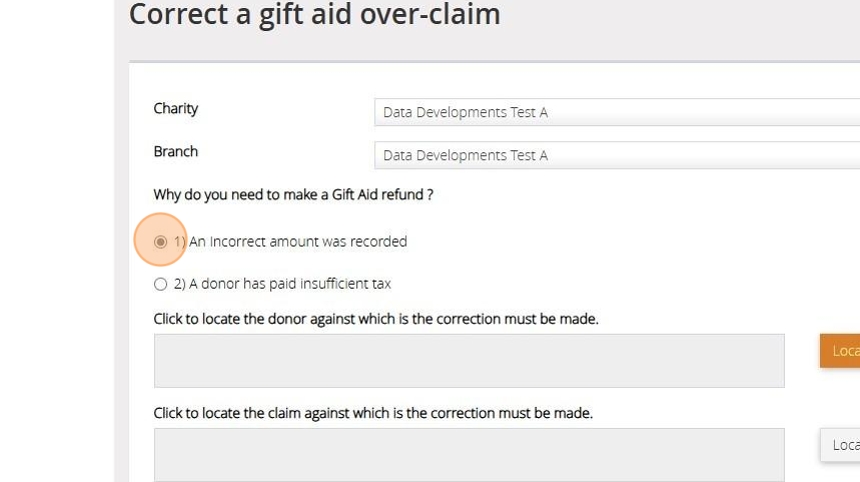

An incorrect amount was recorded

4. First you will need to select if the amount recorded was incorrect or if the donor had paid insufficient tax.

We will first go through the steps needed if a donor has an incorrect amount recorded against their record.

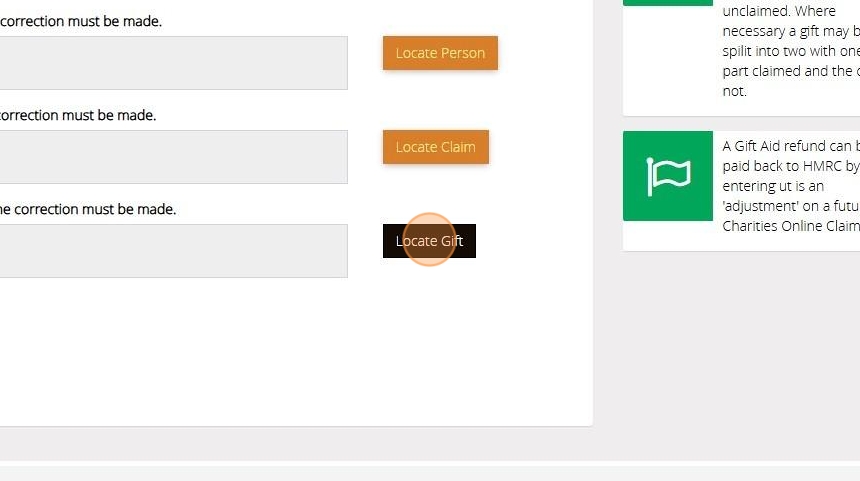

5. Click "Locate Person"

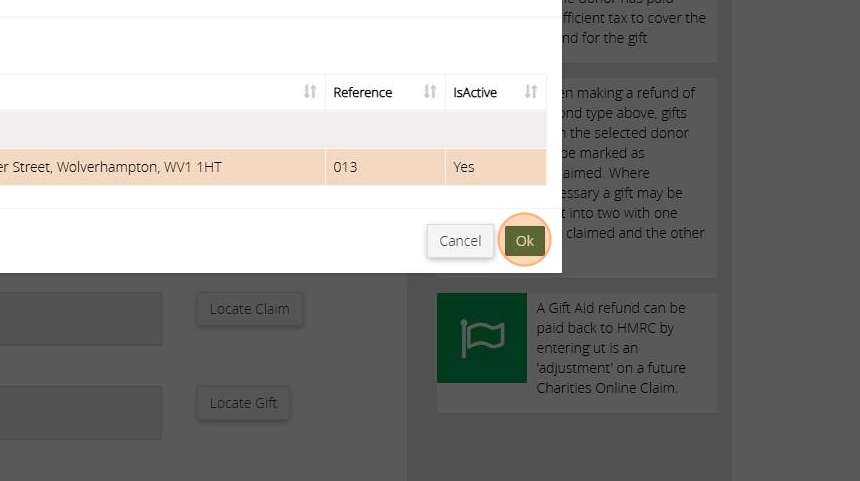

6. Select the donor the incorrect amount was recorded against from the list or search for them via the box provided.

7. Once you have selected the record Click "Ok"

8. Click "Locate Claim"

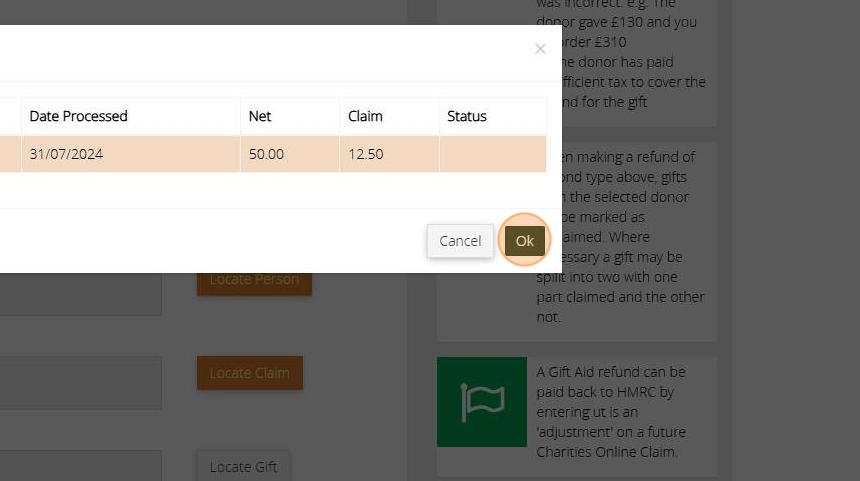

9. Select the claim the donation was included in and Click "Ok"

10. Click "Locate Gift"

11. Select the donation that has been incorrectly recorded and Click "Ok"

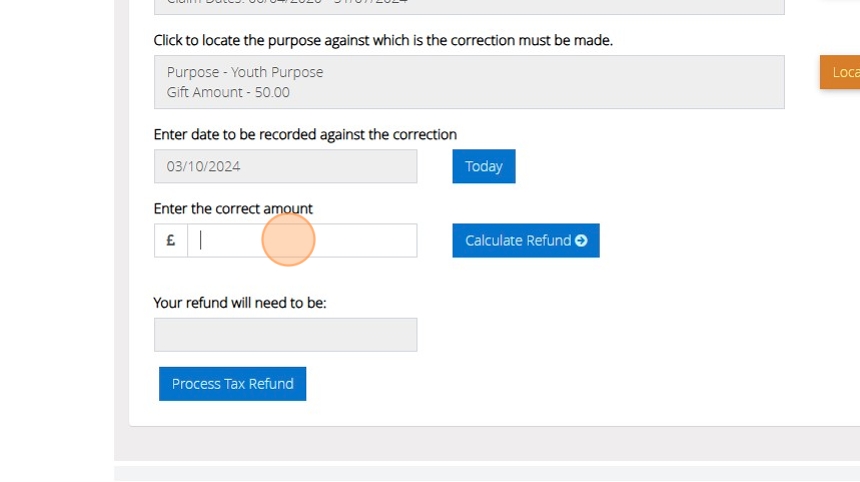

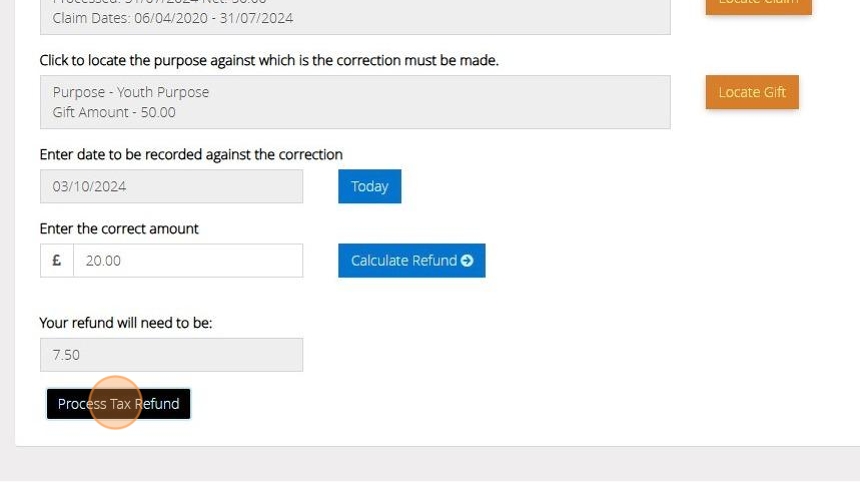

12. Enter the date to be recorded against the correction

Tip! It is best to use the date of the original donation or a date within the tax year that the donation was made

13. Enter the amount that was donated

14. Click "Calculate Refund" to automatically calculate the amount to be refunded to the HMRC

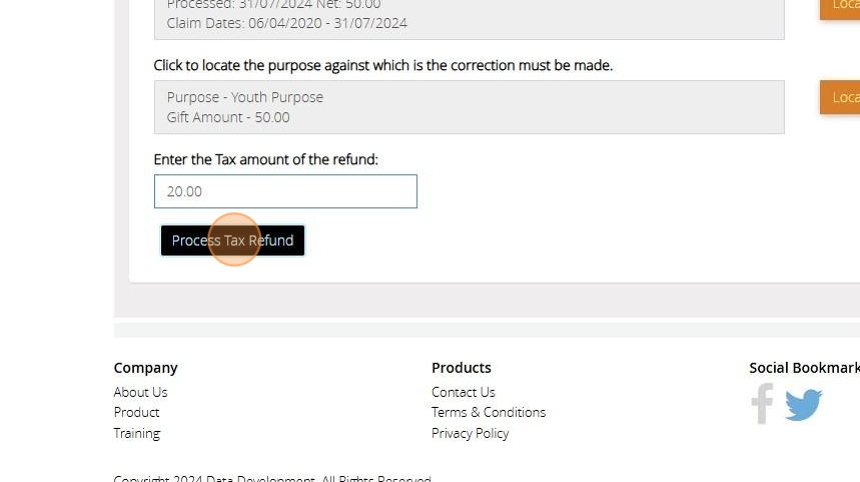

15. Once you are happy with the amount please click "Process Tax Refund"

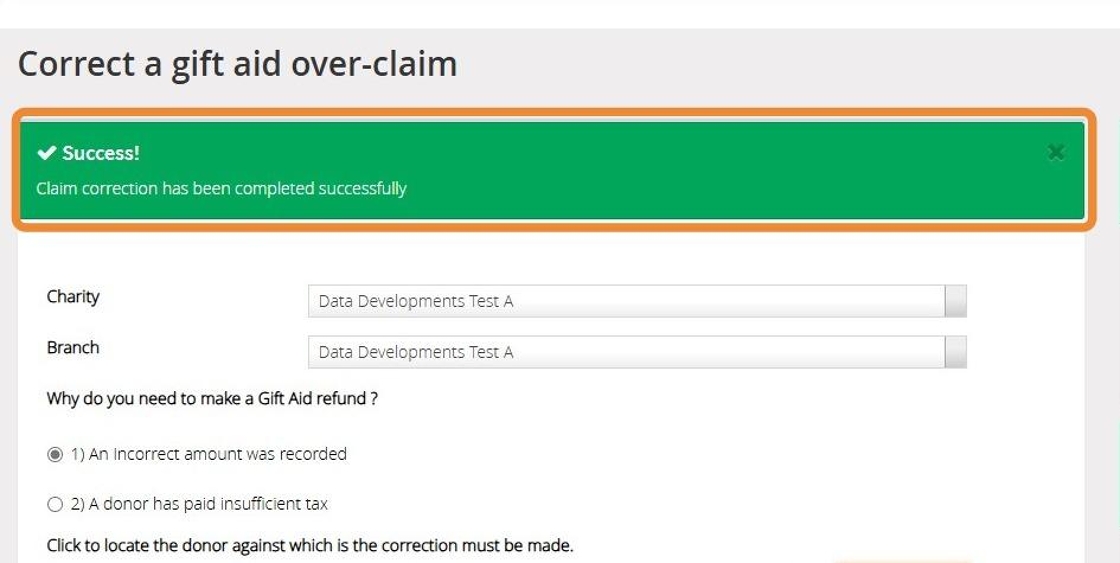

16. The below message will appear once the refund has been created

A donor has paid insufficient tax

17. Select "A donor has paid insufficient tax"

18. Click "Locate Person"

19. Search for your donor record from the list or by using the search box provided.

20. Once you have selected the record Click "Ok"

21. Click "Locate Claim"

22. Select the claim the donation was included in and Click "Ok"

23. Click "Locate Gift"

24. Select the donation that the donor made and Click "Ok"

25. Enter the amount of tax that the donor could not cover here

26. Click "Process Tax Refund"

27. The below message will appear once the refund has been created

Attaching your refund to a Claim

The below steps will show you how to attach a refund to a claim before submitting this to the HMRC. For a more in depth guide on submitting a claim please click here

28. Navigate to https://www.mygiving.online/dashboard

29. Click "Claims"

30. Click "Make a claim"

31. Click "Submit a claim to HMRC"

32. Click "Find Tax Refund" to open a list of all refunds that can be individually selected.

33. Click "Add All Refund" to automatically attach all refunds to the claim

34. You can continue to submit your claim in the normal process. For further guidance on submitting a claim to the HMRC click here

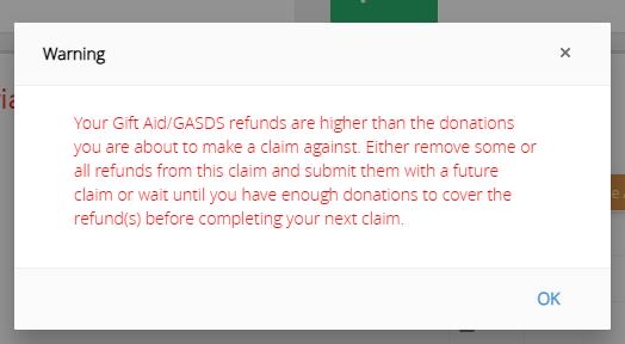

Alert! The HMRC deduct the refund from the claim you are submitting. Due to this the below warning will appear if the amount you need to refund is higher than the amount you are claiming in this claim. You can either reduce the amount of refunds you are including in the claim by using the Find Tax Refund option or wait until you have more gift aided donations to include in the claim